The Best Ways to Pay Off Credit Card Debt (And Some to Avoid)

Paying off credit card debt can feel overwhelming. Maybe you've tried what feels like everything, but nothing seems to work and you’re left feeling stuck and discouraged. Or you’re not sure where to even start because there are so many options. With so much conflicting advice out there, it’s hard to know exactly what to do.

If this sounds like you, know that you are not alone. As a financial coach, I’ve worked with many women experiencing these exact thoughts and feelings.

The truth is, there’s no one-size-fits-all solution. The best approach depends on your financial situation, personality, and what will keep you motivated. And often, the best approach combines multiple strategies.

In this post, we’ll go through some of the most common debt payoff strategies—the ones financial experts recommend, plus the ones people often consider (even if they’re not a good idea). For each, I’ll break down the pros and cons so you can make an informed decision about what’s right for you.

Note: these strategies are specifically for credit card debt. Student loans and medical debt have different considerations and these recommendations may or may not apply.

Ways to Pay Off Credit Card Debt: Pros and Cons

1. Debt Snowball

A debt snowball is a popular debt payoff strategy that involves targeting the debt with the lowest balance while paying the minimum amount on all other debts. The idea is that paying off your smallest debt will give you a quicker win and encourage you to keep going.

After you pay off your first debt, you take the amount you were paying on it and put it toward the debt with the next lowest balance. Continue doing this until you are debt free.

Pros:

Increases motivation by eliminating smaller debts more quickly

Easy to implement and sustain once you make initial adjustments to your budget

Effective strategy that has worked for many

Cons:

May cost you more in interest if your larger debts have higher interest rates

May take longer to pay off all debt because of increased interest

My Take:

The debt snowball strategy is recommended by popular personal finance guru Dave Ramsey and has helped many people successfully pay off debt. It may be a good strategy for you if you have some smaller debts and you would feel motivated by being able to eliminate some of them more quickly even if they don’t have the highest interest rates.

2. Debt Avalanche

A debt avalanche is similar to a debt snowball except that you start with the debt with the highest interest rate rather than the lowest balance.

Pros:

Allows you to pay off debts with the least amount of money in the least amount of time

Minimizes the total interest you pay

Easy to implement and sustain once you make initial adjustments to your budget

Effective strategy that has worked for many

Cons:

May feel like more of a slog than the debt snowball method (if the debt with the highest interest rate has a large balance)

May take longer to feel like you’re making progress

My Take:

The debt avalanche method makes the most sense from a mathematical perspective because it reduces the amount of interest you pay. If you can stay motivated and focused on the bigger picture, it is an excellent debt payoff strategy.

If you feel like you need a quicker win, you might prefer a debt snowball instead.

Keep in mind that you can also do a hybrid strategy or start with a debt that makes you feel the worst and then move on to an avalanche or snowball.

Doing a debt snowball or avalanche should always be part of your debt payoff strategy.

3. Cutting Expenses

Cut back on spending so you have more money to pay off debt.

Pros:

Helps you accelerate your debt payoff journey

Builds habits that will help you save more in the future

Cons:

It’s hard to give up things and may not be sustainable in the long term

My Take:

Cutting expenses is almost always a key part of paying off debt, especially if spending too much is what caused the debt in the first place. However, it’s emotionally challenging and creates a sense of deprivation, which can make you want to give up.

Getting out of debt almost always requires cutting back on spending and reducing expenses, but it’s important to not be so extreme that you can’t sustain it.

Start by cutting back on things that aren’t creating that much meaning or value in your life. Find ways to reduce costs without making sacrifices. If more cost cutting is necessary, make sure that you include some money to be spent on things you enjoy or that are important to you. Doing so will help you stay on track.

Resources to Help You Save Money

4. Finding Extra Money (Increasing Income)

This could mean finding another job or source of income, asking for a raise, or selling items that you have at home.

Pros:

Can help you pay off debt faster

Cons:

Requires additional time and effort

May not be realistic depending on other life obligations

Could lead to burnout

My Take:

Selling items you have at home can be a quick way to get some extra money, though it may or may not generate enough extra to make a difference and takes time. If you can easily identify some things to sell, then it’s certainly worth trying! But remember that it may not be the best use of your time or energy.

Asking for a raise can be a great option, though it may not always be possible depending on your work situation and employer. Be sure to build an argument for why you should get a raise to improve your chances. Here are some tips to help you negotiate a raise.

Earning additional income with an extra job or side hustle can be a great option for those with the capacity to do so. If you don’t have much time, consider things that you could easily integrate into your life. For example, maybe you could care for another child in addition to your own once in a while. Or you could take care of other people’s homes or pets while they are away. Get creative and search the internet for easy ways to make money.

5. Ask For a Lower Interest Rate

Call your credit card company and ask for a lower interest rate.

Pros:

If it works, it’s an easy way to reduce the interest you’ll pay and the time it takes to pay off your debt.

Cons:

Doesn’t always work or may take persistence

My Take:

Asking for a lower interest rate is low risk and always worth a try. It should be combined with some of the other strategies above for optimal effectiveness.

6. Putting Every Available Dollar Towards Debt Whenever Possible

This strategy involves finding any money that is available and putting it toward debt. If you get a tax refund? Put it toward debt. Extra money at the end of the month? Debt. Money in savings? Pay off your debt.

Pros:

By putting more money toward your debt you can pay it off faster

Cons:

If you do this too much, you might end up having to use debt to pay for surprises, emergencies, and things you forgot.

My Take:

When you’re trying to get out of debt, it seems like it would make sense to put every dollar you can possibly find toward your debt. And this is true, to an extent. What tends to happen is that people put so much money toward debt that they don’t have anything left to pay for all of those random things that come up in life. Then they have to use debt to pay for those things, perpetuating the debt cycle.

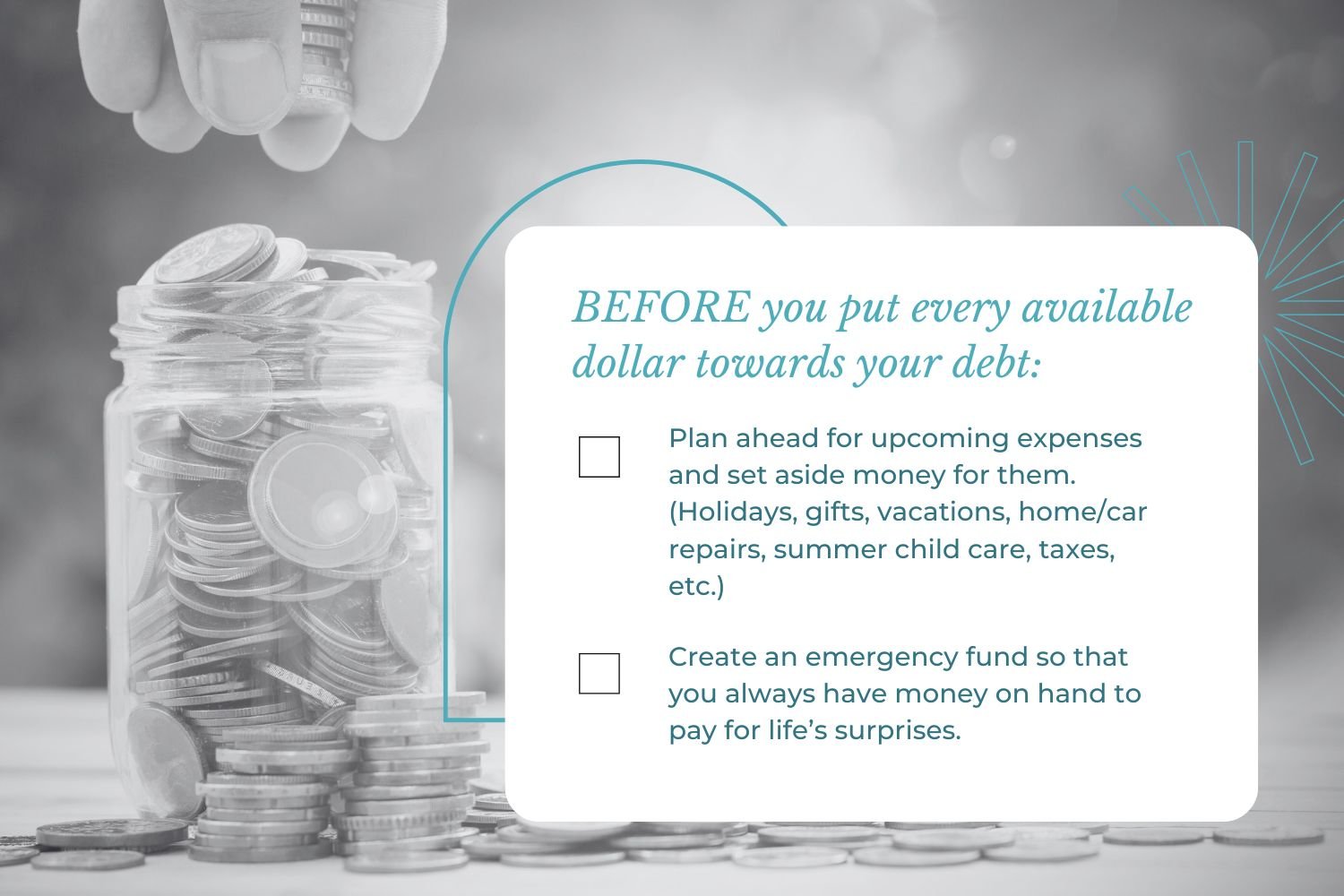

The key is to make sure that you first:

Plan for upcoming expenses (seasonal things, holidays, travel, home repairs, new car, etc), and

Keep money on hand for when life happens (an emergency fund)

Once you do that, you can put all of your extra money toward debt. This strategy will help you continue making progress and stay out of debt.

Learn More: Why Paying Off Debt Too Fast Can Backfire (And How to Break the Cycle for Good)

7. Balance Transfer Cards

Transfer all or part of your high-interest debt to a credit card with a 0% interest promotional period, usually for 15-21 months. This allows you to more aggressively pay down the balance without accruing additional interest.

Pros:

Allows you to make progress on your debt faster

Prevents additional interest from accruing for a period of time

Cons:

After the promotional period is over, the interest rate will skyrocket

You might not be able to transfer your entire balance because there is a limit on what you can transfer

Comes with balance transfer fees

May give you a false sense of progress

Some cards retroactively charge you interest if you don’t pay off the full amount during the promotional period.

My Take:

Balance transfer cards can be an extremely helpful tool in helping you pay off your debt faster with less interest. However, they are not a complete debt payoff strategy and must be used in conjunction with other strategies.

What often happens with consolidation strategies (balance transfer cards and some of the options below) is that they make you feel like you’ve done something to make progress, but in reality, you are just moving your debt around.

If you do not also stop accruing debt and address the underlying reasons for the debt first, you may just be delaying the pain and end up in a worse position.

To make the most of balance transfer cards:

Reduce spending so that you are no longer accruing more debt

Set aside money for upcoming expenses and for emergency/surprise expenses. This will help you cover future expenses without having to rely on debt.

Aim to pay off the debt within the promotional period if possible, if this is your only debt.

If you are not able to pay off the entire balance within the promotional period, you might be able to transfer the remaining amount to a new balance transfer card.

8. Personal Consolidation Loans

Another popular option is to consolidate credit card balances into a personal consolidation loan.

Pros:

You might qualify for a lower interest rate than you are paying on your credit cards

Only one monthly payment

Might help you raise your credit score because you would be paying off your credit cards and lowering your credit utilization rate (though a temporary drop may occur due to the hard inquiry on your credit report)

Cons:

Similar to balance transfer cards, this strategy won’t work if you don’t address the underlying reasons for the debt

You might not qualify for a lower interest rate if your credit score is too low

If you can’t make the monthly payment, there could be steeper consequences than you would have with a credit card

Often come with origination fees that might not make it worth it

My Take:

Personal consolidation loans can be a good idea once you are certain that you have stopped using debt and can easily make your full payments. They may be especially beneficial if you have a higher credit score and qualify for a significantly lower interest rate than you have on your credit cards.

9. Debt Management Plans

Work with a non-profit credit counseling agency to create a more structured debt payoff plan. The credit counseling agency helps you negotiate lower interest rates. You make one payment to the credit counseling agency and they pay your creditors on your behalf. All of your debts are repaid in full on a set timeline.

Pros:

Helpful in making an effective plan for paying off debt

Often saves you money with lower interest rates

No need to work with individual creditors (it’s done for you)

Only one payment

Great for reducing the overwhelm of managing too many things

Includes other financial education and counseling, such as help with creating a budget

Cons:

Be careful to find a reputable non-profit credit counseling agency that doesn’t charge excessive fees. There’s a lot of potential fraud and companies looking to take advantage of you.

Usually involves extra fees, though these are often less than the savings you get from lower interest rates.

You will likely be required to stop using credit cards during the plan

Not all debts are included (it is mostly for credit card debt)

My Take:

Debt Management Plans can be extremely helpful for those who are struggling to make a plan on their own and are overwhelmed by the process. They may also be a good alternative to consolidation loans and balance transfer cards because they help lower your interest rates.

As long as you are willing to stop using credit cards and make other changes to your budget, there are few downsides.

If you choose to go this route, be extra careful to work with a reputable non-profit agency. The best way to find one is to go through the National Foundation for Credit Counseling: https://www.nfcc.org/.

10. Using Home Equity

Description: Use a home equity loan or a home equity line of credit to pay off your credit card debt.

Pros:

Lower interest rate than credit cards or personal loans.

One payment with defined timeline

Cons:

Must make full payment or risk losing your home

Puts your home at risk

Might not help if underlying reason for debt is not addressed

Comes with extra fees or closing costs

My Take:

Mortgages and home equity loans or lines of credit are “secured” debt, meaning that they are backed by your home or another asset. If you don’t pay, the lender can take your home. It’s less risky for the lender, which is why you can get a lower interest rate. It’s more risky for you because you could lose your home.

It is generally not a good idea to take “unsecured” debt (like credit cards) and turn it into “secured” debt. If you can’t make your credit card payment, you’ll potentially have to deal with debt collectors, but at least you won’t risk losing your home too.

Although there may be situations where using your home equity to pay off credit card debt works to your advantage, it comes with significant risks and is generally not recommended.

11. Taking a 401k Loan

Description: One of the benefits of a 401k is that you can borrow against it. There are no taxes or fees on loans as long as they are repaid, and the interest is paid back into your retirement account.

Pros:

May offer a lower interest rate

The interest is paid to yourself

Less negative impact than withdrawing money from retirement accounts early.

Cons:

There’s a time limit on how long you have to repay the loan

If you leave your job, you’ll likely need to pay it back in full immediately

Potential loss of growth in retirement funds

If you don’t repay it, it will be treated as a withdrawal and you’ll have to pay taxes and penalties on it.

May not solve the problem if you are still accumulating debt

My Take:

401k loans are another solution that gives you a false sense of making progress. It feels better than having credit card debt and makes you think that you’re paying it off. 401k loans in particular put the debt “out of sight, out of mind” because you’re not making payments—they’re deducted from your paycheck. Many people who use 401k loans to pay off their debt continue to accrue debt and the problem gets bigger.

If you choose this solution, make sure that you have a solid plan for paying off the debt, are not accruing more debt, and have a healthy savings account to pay for upcoming expenses and surprises.

12. Withdrawing Money from IRAs or Roth IRAs

Description: Withdraw funds from retirement accounts to pay off debt. Although there are a few instances in which an early withdrawal is exempt from penalties, most early withdrawals are subject to a 10% tax. In addition, withdrawals from a traditional IRA are subject to regular income taxes.

Pros:

Immediate access to money that can be used to pay off debt

Cons:

Loss of retirement savings

Additional penalties

May have to pay income taxes on withdrawals

Loss of growth potential and tax benefits

May not solve the problem

My Take:

The only reason you would choose this option is if you are willing to sacrifice your retirement savings plus any early withdrawal penalties and potential investment growth just so you can be free of credit card debt. In other words, the financial benefits are rarely worth it, in which case the only benefit is an emotional one (the feeling of having paid off your debt). But even that benefit is not guaranteed if you do not address the underlying cause of the debt.

Although there may be a few situations where this works out without too many significant consequences, there is a huge risk of it not solving the problem and having dire consequences for your retirement savings. Other options should be explored first.

13. Debt Settlement

Negotiate with creditors to settle for less than the full amount. This option should only be considered for past due, delinquent debts that have been sold off to collections agencies AND you have some money that could be used to settle the debt.

Pros:

Can be a way to put an end to debt collectors contacting you and eliminate an old debt

You may be able to settle for less than the original amount

Impact on credit score is not as bad as having unpaid debt in collections

Can prevent lawsuits turning it into a judgement debt with more consequences

Cons:

Significant negative impact on credit score because debt is marked as settled or not paid in full

It can be challenging to talk to and negotiate with debt collectors

Requires caution and careful documentation of agreements

Because part of the debt is considered forgiven, there may be taxes due on the amount not paid

May not be successful

My Take:

If you have been dealing with an unpaid debt and debt collectors and you now have the money to pay this debt, negotiating might be worth a try. Be sure to:

Confirm that the debt is yours

Make sure the person/company you speak to is the correct owner of the debt

Get agreements in writing

Identify how much you can actually pay and start negotiations with a lower amount.

Ask if they will remove the debt from your credit history if you pay it.

Learn more about negotiating a debt settlement on your own.

14. Debt Settlement/Elimination Companies

Hire a company to negotiate a debt settlement on your behalf. These are usually (if not always) scams.

Pros:

Might result in a debt settlement (but probably not)

Cons:

Same as negotiating debt on your own (see above)

High fees paid to the debt settlement company

May not be successful

Probably won’t work

My Take:

This is the one strategy on the list that you should avoid at all costs. There are a LOT of fraud and scams in the debt/credit world. Be extremely cautious with who you speak to about your debt. Anything that sounds too good to be true probably is. Any other option on this list is better than working with one of these companies (including bankruptcy).

15. Bankruptcy

Legally discharge your debts by filing for bankruptcy.

Pros:

Can eliminate some debts (particular credit card debt) and give you a fresh start

Puts a stop to creditor harassment

Can stop home foreclosure and repossession of car

Can stop wage or bank account garnishment

May allow you to start rebuilding your credit score sooner, especially if it is already negatively impacted.

Cons:

Not all types of debt can be eliminated

You might lose some assets depending on type of bankruptcy

Can be expensive

Significant negative impact on credit score in the short term

Might affect your ability to rent an apartment, get a loan, get certain jobs, or buy a home

May not solve the problem if you don’t also address the underlying reason for your debt

Need to work with a bankruptcy attorney

My Take:

Bankruptcy is both overused and underused as an option for dealing with debt. It’s overused in that sometimes people use it as a first resort without trying any of the other options or getting help with making these strategies work. Often, they are unaware that there are other options to try. In addition, many people end up filing for bankruptcy more than once because they didn’t address the underlying issue and continued to accrue debt.

It’s underused in that bankruptcy has such a stigma around it that people avoid it even when it would be helpful. Waiting too long to file for bankruptcy can extend your financial problems for longer than necessary.

So when should you file for bankruptcy? It’s an option to consider if:

You have a large amount of unsecured debt eligible to be discharged in bankruptcy

Your debt payments are more than half your income

You have been sued over your debt

You are facing wage garnishments, utility cutoffs, and other severe consequences

You have tried other methods for paying off debt and are still struggling

For more information, see this article on when to file for bankruptcy from the National Consumer Law Center.

Final Thoughts: Progress Over Perfection

If you’re struggling with debt, you’re not alone—and you are not a failure. Debt happens for a lot of understandable reasons, and while it can feel overwhelming, the most important thing is to develop a debt payoff plan that works for you.

It’s normal to want a fast fix, but true progress takes time. You may need to cut expenses or increase income—but the hardest part is often the emotional burden of debt. Shame, fear, and stress can cloud your judgment, making it easy to make decisions that don’t actually serve you in the long run.

As you move forward:

✔ Don’t let fear or shame drive your decisions. Your debt is a situation to solve, not a reflection of your worth.

✔ Prioritize debts that have real consequences (like housing or wage garnishment) over those with more flexible repayment options.

✔ Don’t let debt collectors pressure you into bad decisions—you have rights, and there are steps you can take to stop harassment.

✔ Seek support if you need it. Whether it’s a non-profit credit counselor or a financial coach, getting guidance can help you save money and reduce stress.

The most powerful step you can take today? Let go of the shame and focus on your next right step. Debt repayment is a journey, and you’re already on the path forward.