Why Paying Off Debt Too Fast Can Backfire

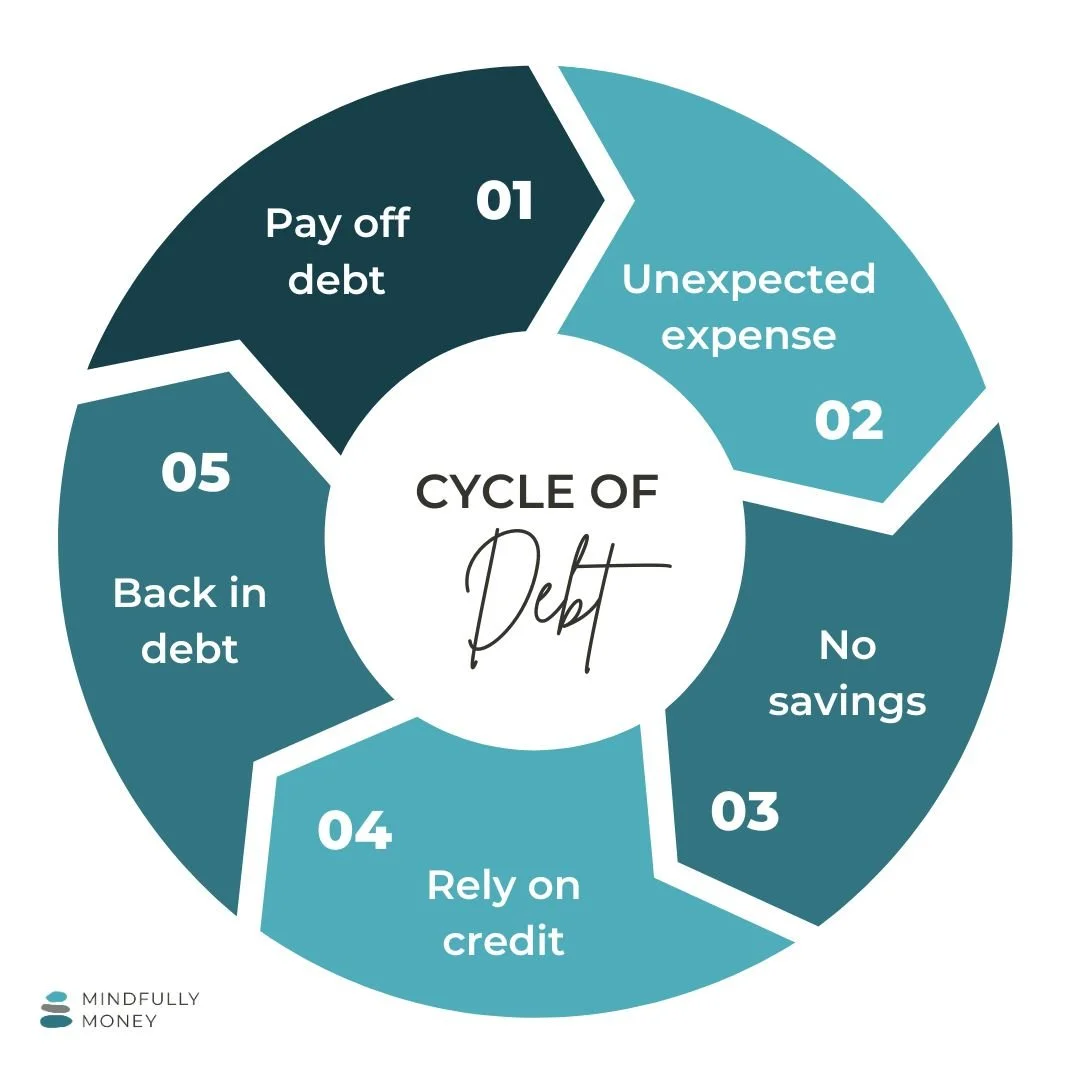

Have you ever felt like no matter how hard you try, you can’t escape the cycle of debt? You pay it off, something unexpected happens, and you’re right back where you started. If this sounds familiar, you’re not alone. It’s not that you’re bad with money—it’s that the advice you’ve been following is setting you up for failure.

Society often tells us to get out of debt as fast as possible, but this approach ignores the reality that life is full of unexpected expenses. Let’s talk about why paying off debt too quickly can actually keep you stuck in it—and what you can do to finally break the cycle.

The Debt Myth We’ve Been Sold

Many of us have grown up hearing that debt is bad and should be eliminated as quickly as possible, no matter what. Debt payoff gurus like Dave Ramsey often advise people to cut every expense to the bone and use every spare dollar to get out of debt.

One of Ramsey’s most repeated pieces of advice is, “the only time you should see the inside of a restaurant is if you’re working there.” This sentiment isn't unique to him—our culture shames people for carrying debt, treating it like a moral failure (unless you’re wealthy and using debt to make even more money).

Besides the fact that I don’t believe in shame as a motivational tool, the idea of sacrificing everything to pay off debt quickly often backfires—and I see this all the time with my clients.

Why "Every Extra Dollar to Debt" Is a Mistake

You’re smart. You’ve probably done your research and maybe even tried a debt payoff strategy like the snowball method or focusing on the highest interest rates first. You think, "I’ll just put all my extra money toward this debt, and soon it will be gone."

But then life happens.

Maybe the car breaks down, you get hit with a medical bill, or an insurance premium comes due that you forgot to budget for. Suddenly, you’re right back to swiping your credit card to cover the unexpected.

When that happens, it’s natural to feel like a failure—like you’ve been doing everything wrong. But here’s the truth: the problem isn’t you. The problem is that most personal finance advice assumes an ideal world where nothing ever goes wrong.

Life is messy. Things come up. That’s why you need to manage your money with an understanding that the unexpected will happen.

Related: How to Get Out of Debt: 7 Key Steps to Creating a Debt Payoff Strategy

The Key to Breaking the Cycle: Saving for Life's Messy Moments

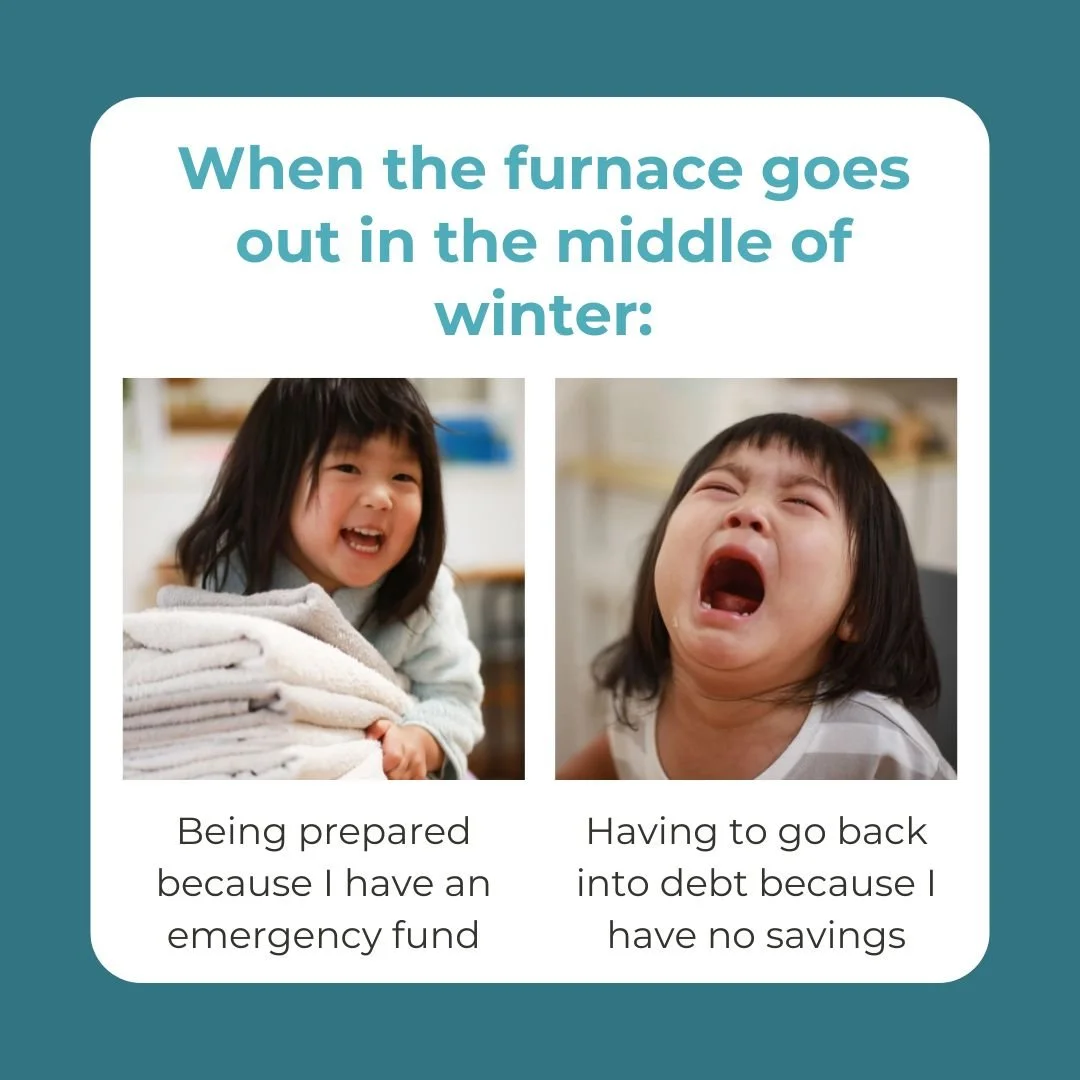

Instead of putting every extra dollar toward debt, it’s crucial to keep some cash on hand for those inevitable "life happens" moments. When you have an emergency fund or savings buffer, you’re prepared for car repairs, medical bills, or even holiday expenses—without having to turn to your credit card.

Here’s why this works:

Example 1: Roof Repair

Imagine this: your roof gets damaged in a hailstorm, and you need $5,000 for the deductible to repair it. You’ve been diligently putting every extra penny toward your debt, so you don’t have an emergency fund to fall back on. That $5,000 ends up on your credit card with an interest rate of 20%.

Now, instead of paying for the roof repair in cash, you’re making payments of $250 a month, and by the time the debt is paid off—over two years later—you’ve spent an extra $1,020 in interest alone.

So, what could have been a $5,000 expense is now $6,020, all because you didn’t have a savings cushion. The debt cycle continues, and that "quick debt payoff" goal just became even harder to achieve.

But what if, instead, you had set aside money in an emergency fund? You could have paid for the roof repair outright and saved yourself over a thousand dollars. No added debt, no extra interest, and no stress.

Example 2: Holiday Spending

Let’s talk about the holiday season—a time of year when extra expenses are almost guaranteed. Gifts, decorations, travel, and celebrations can quickly add up, and if you haven’t planned ahead, it’s all too easy to pull out your credit card. Without any money set aside, you charge $1,200 for gifts and festivities. With an interest rate of 18%, if you make the minimum payment of $50 per month, it will take you nearly three years to pay it off, costing you an additional $370 in interest.

That’s three years of paying for one holiday season, and by the time you’re done, another holiday season has likely come and gone—possibly with new debt to show for it.

Now imagine if you had put aside a little money each month throughout the year. By the time the holidays arrived, you’d have the cash on hand to cover everything. No debt, no dragging payments into the next year, and most importantly, no guilt hanging over your head.

Learn more: How to Deal with Unexpected Expenses

The Temptation to Pay Off Debt Now

I know it’s hard to watch money sit in your account when every instinct tells you to throw it at your debt. It’s completely normal to feel that way, especially since everything you’ve ever heard tells you that having debt is bad and you must eliminate it as fast as possible.

But saving money for the future is the key to breaking the debt cycle for good.

Think of it this way: that money is protecting you from future debt. Every time you resist the urge to use it for debt payoff (or for unnecessary spending), remind yourself, “I’m saving this so I won’t need to rely on credit later.”

It's Not Just About Debt—It's About Peace of Mind

When you start planning for future expenses—whether they’re predictable (like holiday spending) or unexpected (like a car repair)—you’re building a safety net that keeps you from falling back into debt.

And not only are you avoiding extra costs like interest payments, but you’re also gaining peace of mind. You’re giving yourself the freedom to handle life’s curveballs without stress or guilt.

What To Do Next

1. Build a small emergency fund.

If you don’t have savings yet, aim to set aside enough money to cover one month of living expenses as a starter emergency fund. Do this before putting any extra money (above the minimum payment) toward your debt. Once you have that amount, continue paying extra on your debt while working to build your emergency fund to 3-6 months of living expenses.

Learn more: How to Build Your Emergency Fund

2. Create a sinking fund for known expenses.

Start saving now for things like holiday shopping, car maintenance, or annual insurance premiums. Set aside a little each month so you’re ready when these expenses come around.

Learn more: What are sinking funds?

3. Keep paying down debt, but not at the expense of your stability.

Yes, paying off debt is important, but so is staying out of debt. By finding a balance between saving and paying off debt, you’ll make more progress in the long run.

4. Maintain a healthy balance between spending, saving, and paying off debt.

Removing all enjoyment from your life to pay off debt isn’t sustainable. Find ways to cut back within reason so that you can continue making progress without feeling deprived.

Remember:

Debt payoff isn’t a race. The goal is to create a sustainable plan that helps you get out of debt and stay out of debt while still living your life.