What Are Sinking Funds and How Do They Work?

One of the most challenging parts of managing money is figuring out how to plan for all the surprises and unknowns in life. It’s not too difficult to figure out your regular, monthly expenses since they’re fairly consistent. But what do you do when the furnace goes out, your kid suddenly decides to try a new (expensive) sport, or you need to buy a wedding or baby shower gift for a friend?

No matter how hard you try, nobody can anticipate everything. But even if you don’t know what these expenses are, when they’ll occur, or how much they’ll be, it is possible to be at least somewhat prepared.

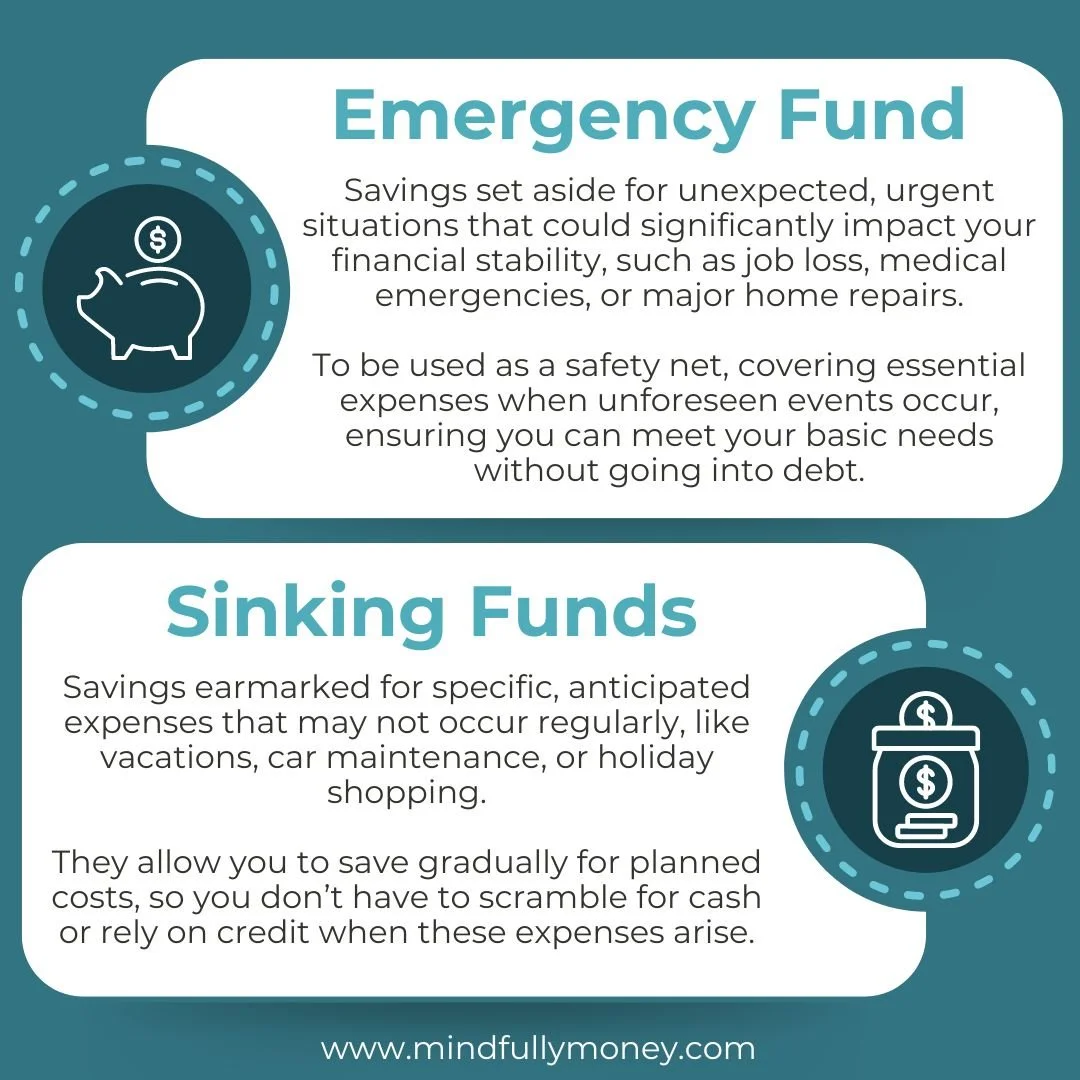

Part of being prepared is having a fully funded emergency fund—a savings account with enough money to pay your bills for at least three months if you lose your job. But an emergency fund is (I know this comes as a surprise) for emergencies. It’s to be used to cover you when unexpected events happen that could have a significant negative impact.

For example, if you lose your job, you still need to pay your rent or mortgage. If you have a medical emergency, you need to pay for care. If a tree falls on your roof, you have to get it fixed so the rain doesn’t cause more damage.

But other surprise expenses aren’t emergencies, and you still need a way to be prepared for them. This could be spending for holidays and celebrations, unexpected fun activities, home repairs and upgrades, or even travel.

To help you prepare for surprises and have enough money on hand for the things you want to do, you need sinking funds.

What are Sinking Funds?

Sinking funds are savings accounts with specific purposes. They help you plan and budget for anticipated expenses so you can save money over time instead of having to come up with a large amount all at once or resort to debt. Sinking funds can help you achieve your short-term financial goals, give you more flexibility, and keep you out of debt.

You may already have a few sinking funds even if you don’t call them that. For example, an emergency fund is a type of sinking fund—a specific savings account reserved just for emergencies. Or you might have a savings account where you set aside money for a vacation. That’s also a sinking fund.

Why is it Called a Sinking Fund?

“Sinking fund” is a term that originally comes from the 18th century when the English government was setting aside money to pay off (“sink”) the national debt.

“Sinking” refers to the process of gradually diminishing something. The money you put in a sinking fund “sinks” into the fund gradually until it’s needed.

The term later migrated to corporate finance, describing when a company would set aside funds to pay off a bond at its maturity. More recently, the term has been used to describe the process of gradually saving money for a specific purpose.

How Do Sinking Funds Work?

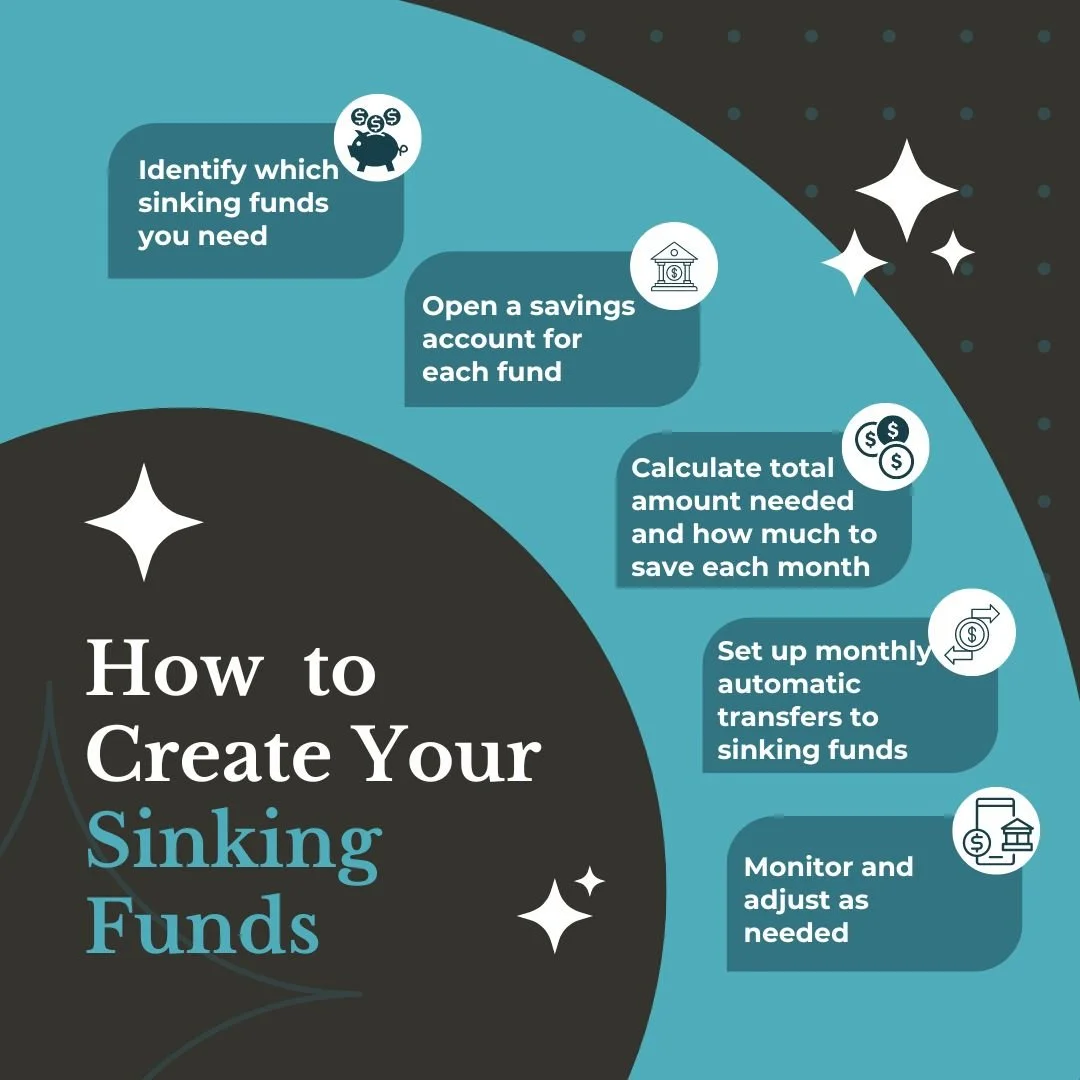

Identify which sinking funds you need.

Open additional savings accounts as needed for each sinking fund.

Set up automatic transfers to your sinking funds each month.

Let the money accumulate until you have enough or need to use it.

Reassess regularly to make sure your sinking funds still align with your goals.

Keep reading to learn more about each of these steps.

What Sinking Funds Should I Have?

Sinking funds can help you save money for anything that isn’t a regular part of your monthly spending. These can be things you know you’ll need in the future, such as a new car, tires, or home repairs. Or they can be fun things or goals, like holiday spending, vacations, wardrobe updates, or home upgrades.

To determine what sinking funds you should have:

1. Brainstorm a list of expenses that have surprised you and caused stress in the past.

Look back over the past year and find the ones you weren’t prepared for. Make a list of these and how much they cost.

2. Think about upcoming expenses.

What home or car repairs do you anticipate needing in the future? Will your kids need new clothes, school supplies, gifts, or activity fees? Do you have any friends who might be having babies or getting married?

3. Consider what you’d like to do in the future.

Do you wish you had more money for fun activities and eating out? Shopping? Vacations? Money is meant to be enjoyed, so if at all possible, plan for at least a few things that make your life more enjoyable.

4. Make a list of everything and group them into categories.

While you could have a separate account for each individual expense, you’ll likely find it too complicated to manage. I highly recommend keeping things as simple as possible.

For example, instead of having separate accounts for kids’ activities, clothes, school supplies, gifts, etc., you could lump them all into one account for kids' expenses.

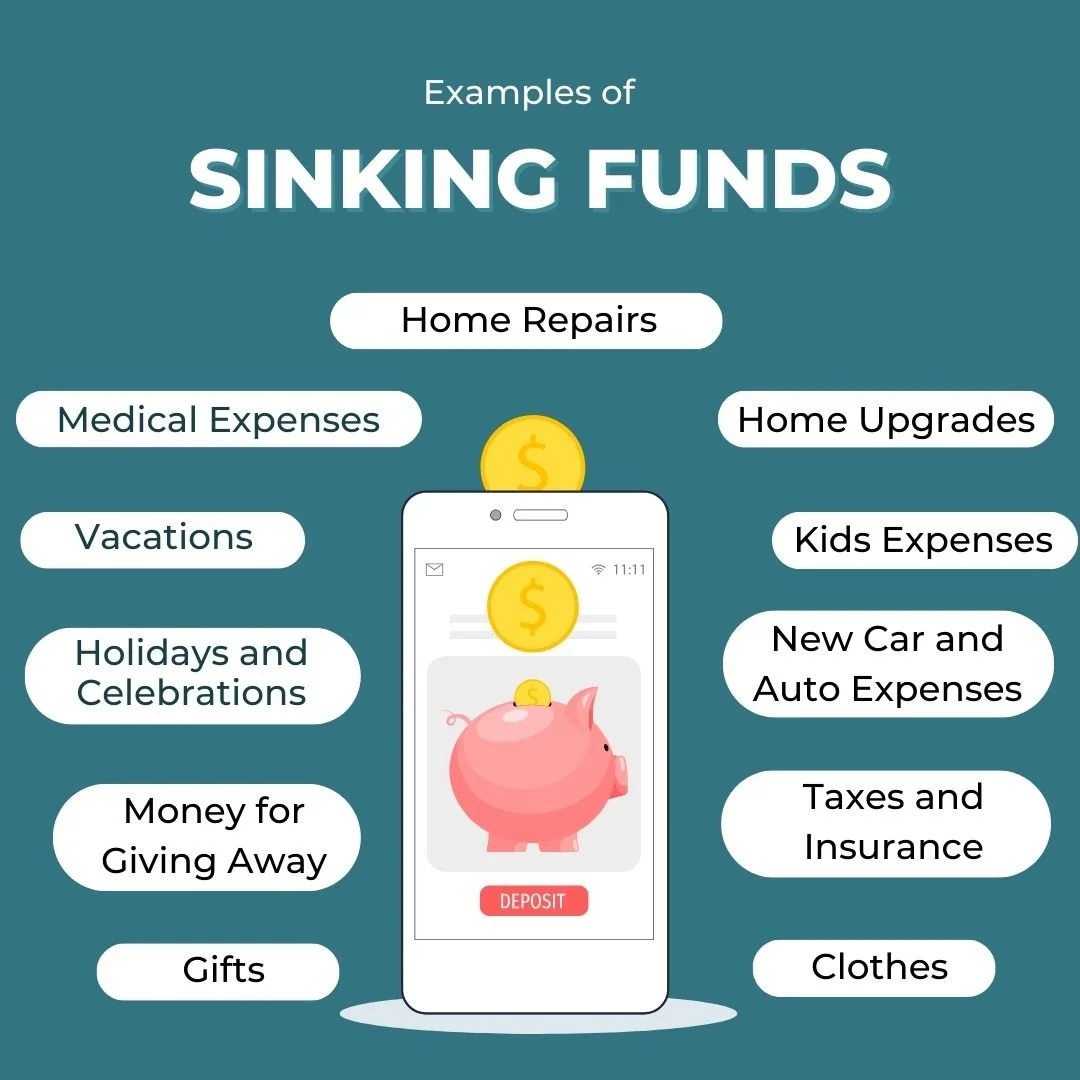

Here are some examples of sinking funds you could have:

Home Repairs

Car Expenses (including a new car)

Travel/Vacations

Fun Activities

Holidays/Celebrations

Kids

Clothing

Pets

Health

Yard care and garden

Summer child care and camps

Education

Money to help family

Donations

Taxes

Remember, you don’t need to have all of these. If you only spend a little on one of these and can easily cover it as part of your monthly spending plan, there’s no need to have a sinking fund.

How Many Sinking Funds Should I Have?

There’s no magic number for how many sinking funds you should have. Everyone’s needs are different. Your goal is to find a balance between having enough to make your money less stressful without having so many that it’s too complicated to manage.

Sinking funds are designed to make your life easier by ensuring you have enough when things go wrong or when opportunities arise. It might make sense to start with a few key funds and add on as needed.

How Much Should I Put in My Sinking Funds?

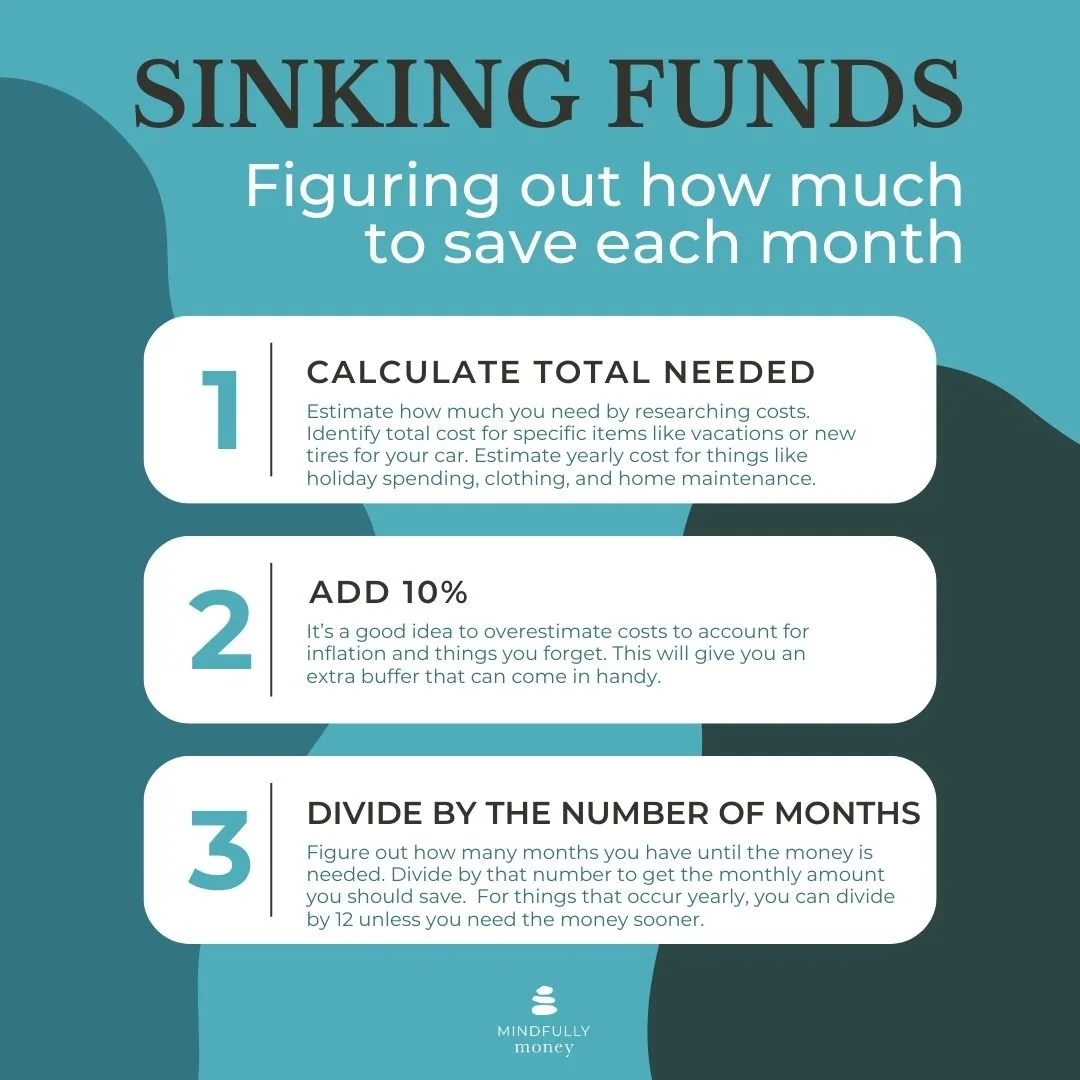

The amount you need to save in each sinking fund depends on the expected cost of the expense and the timeframe you have to save.

For recurring expenses like holiday gifts or annual insurance premiums, calculate how much you’ll need and divide that by the number of months until the expense is due. For example, if you expect to spend $1,200 on holiday gifts and it’s 12 months away, you’d set aside $100 per month.

For less predictable expenses like home repairs, you might estimate an annual amount based on past experience or research. If you’re unsure, it’s better to overestimate than underestimate. Having too much in a sinking fund isn’t a problem—you can always reallocate those funds later if you need to.

Here are some ways to estimate how much you’ll need:

Look at how much you’ve spent in the past.

Research current costs.

Plan on spending 1-4% of your house’s value on home maintenance each year.

Ask neighbors, friends, and family in your area how much they’ve spent.

Google the average cost of each item in your area.

Then increase the amount by 10% to account for inflation and things you forgot. It’s always better to have extra on hand!

Examples:

Example 1:

Let’s say you want to take the kids to Disney in 18 months. Your research found that the average cost of a trip in 2024 is about $6,900. You increase that by 10% ($6,900 x 1.1) and get $7,590. So you need $7,590 in 18 months. $7,590 ÷ 18 = $422.

You set up an automatic transfer of $422 per month into your vacation fund.

Example 2:

You own a house worth $300,000 and decide to set aside 1% of the value ($3,000) per year for home maintenance based on common recommendations and past expenses. Since you need that amount each year, you divide $3,000 by 12 and learn that you should put $250 each month into your home maintenance account.

What if You Don’t Have Enough?

As wonderful as it would be to have enough to save for everything we want and need, that just isn’t the reality for most people. Don’t feel bad if you’re in that position. Even high-earning celebrities, business owners, and lottery winners sometimes find that they can’t afford everything they want.

So if you’re in this position, start by having a little self-compassion, and then move on to some of these practical strategies:

1. Prioritize your goals

Start by making a list of all of the things that you want and need. Include your financial goals, experiences you want to have, purchases you want to make, and all of the things you need to sustain a basic standard of living.

Then rank these in order of importance. Prioritize the things that you absolutely need in order to live and maintain your life (housing, food, health, transportation, utilities, phone/internet, and basic levels of clothing and personal care).

Then identify the “wants” that are most important to you. This will help you allocate your resources to the things that matter most.

2. Lower the monthly amount you need to save for your goals by extending the timeline, reducing the overall cost, or both.

If you can’t afford to save for everything you want and need, one option is to make adjustments that lower the monthly amount you need to save. You can do this by:

1. Extending the timeline

Extending the timeline gives you more time to save, thereby reducing the monthly amount you need to save. For example, you could decide to do the Disney trip in two years instead of 18 months. Adding another six months would reduce the monthly amount you need to save from $422 to $316.

2. Reducing the overall cost

Another option is to reduce the cost. Maybe you decide to be extra frugal and instead of spending $7,590, you do some research on saving money at Disney and decide you can do it for $6,000. Taking a $6,000 trip in 18 months would require saving $333 per month.

Check out these tips for traveling on a budget.

3. Both

If you did both of these things (reducing the cost to $6,000 and extending the timeline to two years), you would only need to save $250 per month.

3. Reduce “regular” spending

If you don’t have enough for your sinking funds, savings, debt payments, and everything else, you may want to consider cutting back in other areas—in your everyday spending.

This might mean figuring out ways to lower your monthly bills by finding a place with cheaper rent, refinancing your mortgage, negotiating lower rates on cable/internet, finding cheaper providers, switching to a budget phone plan, shopping around for lower insurance rates, and more.

You can also track your purchases for a few weeks to determine how much you are actually spending in various areas. This can give you insight into where your money is going and help you make more intentional decisions about where you want your money to go.

4. Increase your income

Adding extra income by getting a new or additional job, asking for a raise, or selling things you own for a one-time boost can be another effective way to add money to your sinking funds.

5. Expand your emergency fund and use it for all unexpected expenses

In an ideal world, we would have enough saved to cover everything that comes our way, but that’s not always possible.

Generally speaking, it’s rare for all these surprise/emergency expenses to occur simultaneously. So instead of having separate sinking funds for every possible scenario, you could lump things together or expand your emergency fund to cover multiple types of expenses.

For example, you might have one general “household” sinking fund that covers home repairs, car repairs, and unexpected medical costs. This approach simplifies your savings process, reducing the number of accounts you need to manage. Alternatively, you might decide to boost your emergency fund to a level where it could comfortably handle these types of expenses when they arise, allowing you to maintain fewer separate sinking funds.

If you choose this route, aim for a larger emergency fund that holds enough to cover 9-12 months worth of living expenses (if possible). And be sure to continue setting aside money for bills and expenses that you KNOW will definitely occur in the future.

How is a sinking fund created?

To create your sinking funds, you’ll need to open a few more savings accounts or find one that allows you to subdivide your savings. Although I have not used them, many people report being happy with Ally bank due to their ease of use, ability to have multiple savings buckets in your account, and high interest rates.

You can also check Nerdwallet, a site that regularly reviews options for banks and credit unions that allow you to have multiple savings accounts.

How do you manage your sinking funds?

Automate

One of the easiest ways to manage your sinking funds is to automate your savings. Set up automatic transfers from your checking account to your sinking funds each payday. This way, you’re consistently contributing to your goals without having to think about it. Automation can help you stay disciplined and ensure that you’re consistently working towards your financial goals.

Be flexible

It’s essential to be flexible with your sinking funds. Life is unpredictable, and your needs will change over time. You might find that you need to adjust the amount you’re saving, redirect funds from one category to another, or even combine or eliminate certain sinking funds as your financial situation evolves.

Regularly reviewing your sinking funds and making adjustments as needed will help you stay on track and ensure that your money is working effectively for you. Flexibility also means being realistic about what you can save each month. If you’re finding it difficult to contribute to multiple sinking funds, prioritize the most important ones and gradually work towards funding the others.

Include transfers in your budget

When you transfer money into your sinking funds, you generally count this as an "expense” in your budget because it is money that is no longer available for other purposes.

When you transfer money back to your checking account to pay for things, you would count it as income, as it is money coming in to your checking account that can be used to pay bills.

This is just one way to manage this money. If you need help setting this up, a financial coach can help you figure out the best system for you.

Final Thoughts

Sinking funds are a powerful tool for managing your money and planning for future expenses. By saving gradually over time, you can avoid the stress of scrambling to come up with large sums of money all at once.

Remember, there’s no one-size-fits-all approach to sinking funds. The right number and types of funds will depend on your individual circumstances, goals, and financial situation. Start small, focus on what matters most to you, and adjust as needed. Over time, you’ll find a system that works for you, giving you peace of mind and helping you achieve your financial goals.