8 Smart Ways to Use Credit Cards to Your Advantage

Credit cards often get a bad reputation due to the fact that so many people have gotten into trouble using them, but they’re just a tool that can be used to your advantage.

According to a 2024 study from Bankrate, 50% of Americans carry a balance on their credit cards from month to month. In other words, they don’t pay the full balance each month.

This leads some to swear off credit cards entirely, claiming they cause you to overspend and only lead to trouble. “Cut up your credit cards,” they say. “There’s no such thing as using credit cards responsibly!”

Credit card debt is indeed a serious issue, and it’s understandable why people have negative feelings about credit cards when they cause so much stress. At the same time, recommending everyone give them up entirely is a rather extreme response.

The reality is that credit cards are just a tool that can be used to your advantage. But like any tool, they can also lead to problems if used incorrectly.

Think of credit cards like a saw. A saw can be used to create amazing things, but if you’re not careful, you could end up losing a finger. Similarly, credit cards can help you manage your money, earn rewards, and even go on vacations. But used the wrong way, they can lead to serious trouble—trouble so bad that you might prefer losing a finger.

Advantages of Credit Cards

Credit cards have many advantages when used properly:

Rewards in the form of points, miles, or cash back

Fraud protection (you don’t immediately lose money as you would with a debit card)

Building credit when used responsibly

Consumer protections such as warranties, insurance, or the ability to stop payment to a fraudulent vendor

Convenience (accepted at more places, no need to carry cash)

Money management (tracking and categorizing expenses)

Access to funds (useful in emergencies, but also potentially dangerous)

Disadvantages of Credit Cards

The main disadvantage of credit cards is the potential to get into trouble if you don’t use them the right way.

(Side note: If you've gotten into trouble with credit cards, it’s not because you “made stupid decisions” or are bad with money. Many factors contribute to debt, and it’s not your fault. You did the best you could with the information and resources you had. So stop being so hard on yourself! If you don’t believe me, schedule a call, and I’ll explain how it’s not your fault.)

How To Use Credit Cards to Your Advantage

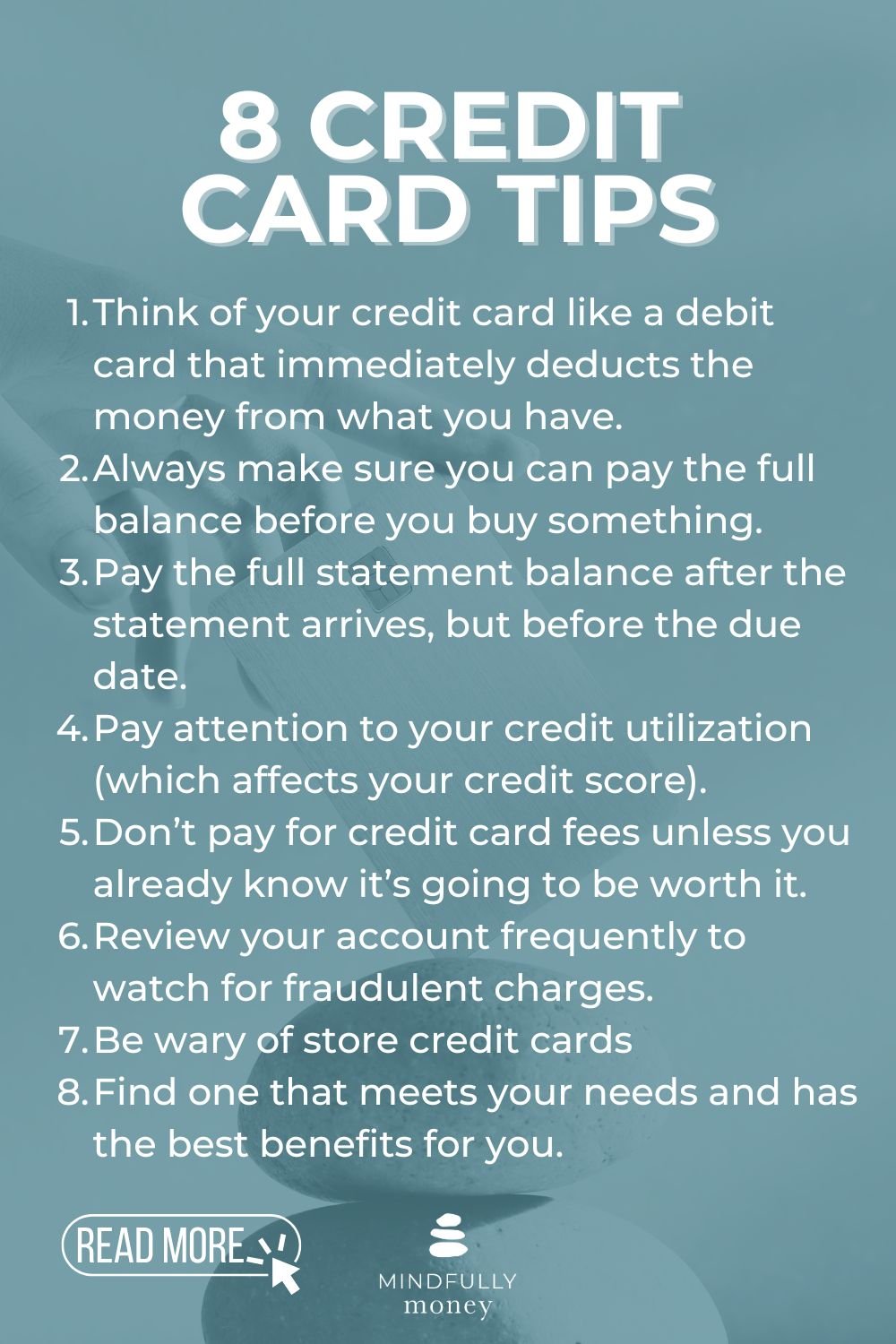

Here are eight tips to help you use credit cards properly, so you can take advantage of the benefits without falling into a pile of debt:

1. Think of Your Credit Card Like a Debit Card That Immediately Deducts Money

This is probably THE most important tip I could ever offer you—especially if you find yourself spending more money than you’d like or if you have credit card debt.

You need to treat every credit card purchase as if it’s coming directly out of your checking account, like a debit card or a check.

What this does is increase the pain of buying something in the moment, which can ultimately lead you to be more cautious with your money.

Many people report that they spend more when they use credit cards than they would using cash. This happens because credit cards detach you from the immediate pain associated with buying something. You get the item now, but you pay for it later. Your brain gets the dopamine hit from getting whatever you’re purchasing, but the pain of losing the money doesn’t happen until later (when you pay your bill).

To understand this, imagine buying clothes with a credit card—it feels easy to swipe, right? Now imagine paying with cash. Many people notice a difference because cash feels more tangible, making the loss of money seem more real.

Of course, one straightforward way to reduce your spending is to give up your credit cards and use cash exclusively. If you struggle with overspending, this may be the best thing you can do.

However, if you don’t want to go to that extreme and prefer using credit cards, practice imagining it as a debit card where money is deducted immediately. Picture your bank account balance decreasing with each purchase. You may find it helps curb spending over time.

Ultimately, know yourself. If your credit card is causing you to overspend or get into financial trouble, don’t use it.

2. Always Make Sure You Can Pay the Full Balance Before You Buy Something

Credit cards make it incredibly easy to buy things when you don’t already have the money, but it’s important for your financial health that you resist the temptation.

(The exception is extreme emergencies, such as a house fire, natural disaster, or medical emergency. Ideally, you’d have savings to cover these, but a credit card can serve as a backup plan.)

For everything else, ensure you can pay the full balance when you make the purchase. This keeps you out of debt, saves you money on interest, and reduces stress.

(PS: It’s a myth that you should carry a balance on your credit card.)

3. Pay the Full Statement Balance After the Statement Arrives, But Before the Due Date

Many people pay off their credit card balance immediately after making a purchase or every week. While paying in full is great, doing so before the statement date won’t help build your credit score.

Credit card companies report your payment history to credit bureaus based on your monthly statement. To improve your credit score, pay your statement balance after the statement date but before the due date. Your payment should cover the statement balance, not the total outstanding balance.

Check out this guide to paying your credit card in full for more details and examples on how to do this.

4. Pay Attention to Your Credit Utilization (Which Affects Your Credit Score)

Credit card utilization refers to the percentage of your available credit that you’re using. To calculate it, divide your outstanding balance by your credit limit.

Keep this number under 30% (the lower the better).

Why? The theory is that a low credit utilization means that you are more financially stable and have more money available to pay your bills/loans. If you max out your credit cards, creditors worry that your finances are tighter and you don’t have the resources to make your payments.

(Whether or not this is always true is another discussion, but that’s currently how the credit scoring system works.)

To lower your credit utilization:

Reduce your outstanding balance.

Keep your spending under 30% of your limit.

Make extra payments before the statement date if you have an unusually high expense.

Request that the credit card company increase your credit limit (Only do this if you are certain it will not cause you to spend more or get yourself into more debt.)

Learn more: The Complete Guide to Your Credit Score

5. Don’t Pay Credit Card Fees Unless You Know It’s Worth It

Credit card rewards programs can be extremely enticing. Who doesn’t want free flights, upgrades, points, etc? These programs can have some amazing benefits!

But they’re only worth it IF you take advantage of them AND you pay your balance in full every month. If you don’t pay your balance in full, the interest charges will outweigh any rewards.

Plus, the benefits offered by the card have to add up to more than the annual fee.

Be honest with yourself—are you paying an annual fee for rewards you don’t use? If so, consider switching to a no-fee card with basic rewards.

Personally, I like using cash back cards because it’s so much easier to manage. Maybe there will be a time in my life where a rewards card with an annual fee is worth it, but that time is not now.

So be sure to analyze cards with annual fees carefully and make sure that the fee is worth the rewards you’ll get based on how much you spend.

There’s no one best credit card for everyone. Find the one that meets your needs and has the best benefits for YOU.

6. Find a Credit Card That Meets Your Needs and Has Benefits You’ll Use

If you’re going to have a credit card, you might as well be getting some extra benefits from it. The only reason to have a card with no benefits is that you don’t want to go through the effort of finding a new one. It doesn’t need to be complicated—it can be as simple as a free cash back card.

In addition, read up on the extra benefits of having a credit card, such as product warranties, insurance, and purchase protection. You never know when these might come in handy!

7. Be Wary of Store Credit Cards

Pin this to save for later!

Store credit cards are not necessarily bad. I’ve had them and used them to my advantage. However, they do tend to get people into more trouble because it’s so easy to get sucked in by the discounts.

Do you find that you buy more simply because there is a promotion or because you get an email from the store? If so, you may want to carefully consider whether the card is worth it for you. The extra items you purchase may cost you more than the amount you save by getting the discount. And if you don’t pay the card in full every month, the interest you pay makes those items extra expensive.

8. Review Your Account Frequently to Watch for Fraudulent Charges

Scams, fraud, and identity theft are rampant and it’s important to know how to protect yourself. Credit cards tend to offer you extra protections, but you want to make sure that you identify and report fraudulent charges in a timely manner.

(Debit cards offer some protection, but how much depends on the company. Federal law guarantees that if you report the fraudulent charge within 2 days, your liability is limited to $50. If you wait longer (or don’t notice it), your liability increases and you could even be liable for the full amount lost. Credit cards give you much more time and you may not lose anything.)

It’s important to always pay attention and identify problems quickly to reduce the impact. You can do this by:

Checking your credit card at least every few days to review transactions.

Setting up alerts. You can usually get texts and emails to tell you if there has been any purchase, a purchase over a certain amount, or more than a set number of purchases in one day.

It’s also a good idea to let your credit card company know when you’re traveling. And you can lock any card you don’t use frequently.

Credit cards can be powerful tools when used wisely. By following these tips, you can take advantage of their benefits without falling into the trap of debt. Remember, it’s all about understanding your spending habits, using credit responsibly, and making informed choices that align with your financial goals. If you're ready to feel confident in managing your money and credit, take the next step today and reach out for personalized advice!