How to Deal with Unexpected Expenses

Unexpected expenses are one of the biggest reasons why budgets fail. By using smart budgeting techniques, you can prepare ahead and reduce the stress when life throws financial surprises your way.

Have you ever had one of those weeks where it feels like everything hits you all at once?

I recently saw a story about a woman who had to take her dog to the vet and it ended up costing $400. Then on the way home her car overheated. Between the tow, repairs, and car rental, it was another $1200. And on top of it, she got home and found a busted pipe and water all over the floors.

Luckily, she had been building up an emergency fund to help pay for some of these expenses. But even if you have enough saved, it’s disheartening when you’ve worked so hard to build up your savings and it quickly disappears due to circumstances beyond your control.

Understandably, this woman wanted to know how to plan for unexpected expenses so that it’s not so stressful and doesn’t have such an extreme impact on your finances.

How to Budget for Unexpected Expenses

The key to budgeting for unexpected expenses is to plan for unexpected things to happen. This may seem a little crazy—how can you plan for things that you don’t know about?

But if you think about it, few things are truly and completely unexpected. With many surprise expenses, you do have at least a general idea of what the possibilities are.

For example, as a homeowner, I know that things are going to go wrong. I have no idea what it will be—a tree falling on the roof, the water heater breaking, the drain backing up, an electrical problem, etc. But I feel pretty confident that something WILL happen at some point. That’s just the reality of owning a home (particularly an old home).

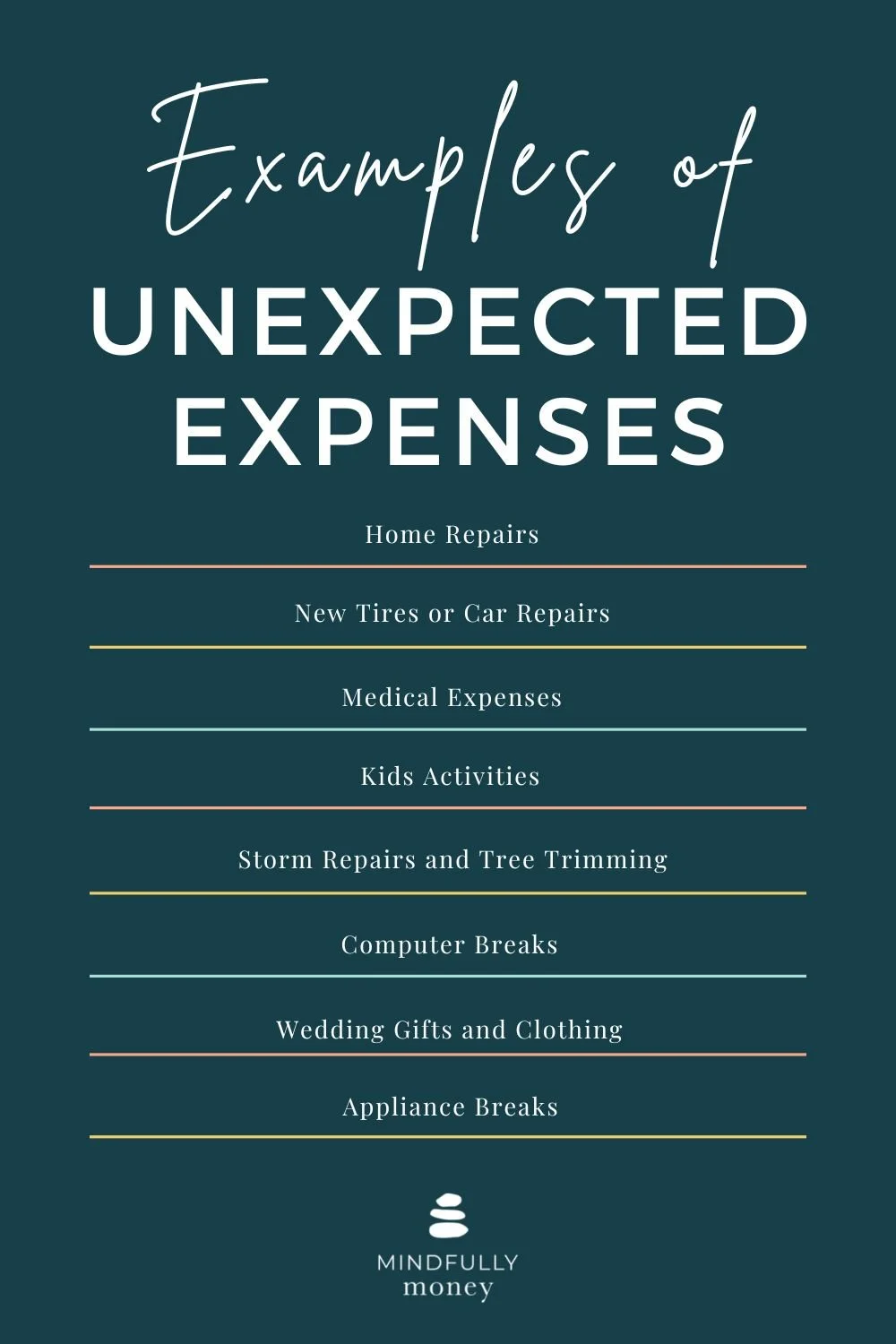

Here are a few more examples of unexpected expenses that you can anticipate to some extent:

If you’re in a stage of life where people are getting married and having babies, you can anticipate that you might be going to weddings and baby showers in the near future, even if they haven’t been scheduled yet.

You might not know exactly what medical care you and your family will need over the course of the next year, but you could make an educated guess based on previous years. (Catastrophic medical conditions/emergencies count as one of those truly unexpected things that nobody can reasonably anticipate.)

If you’ve had your car for a while, you can expect that you might soon be needing new tires, some maintenance, or even a new car.

If you’re a parent, you know that there’s a good chance your kid will need child care on days off school, decide to sign up for (expensive) activities, suddenly need bigger clothes, and more.

The key is to identify what unexpected expenses are possible or likely and to start setting aside money for those now. Even if you don’t know the timing or exact amounts, you can still make an educated guess.

Wouldn’t you rather plan ahead and have 80% of the money saved than having nothing saved at all?

Isn’t my emergency fund supposed to cover unexpected expenses?

Emergency funds are a critical part of building financial stability and being able to survive when the unexpected happens. But they are not enough.

Emergency funds are really designed to protect you from truly catastrophic events that sacrifice your ability to earn income and/or pay your bills. This includes things like job loss, significant medical events/conditions, and home repairs beyond what you could reasonably expect.

They are not designed to cover all of those more regular surprises that happen in life. (A friend’s wedding or a tree needing trimming are NOT emergencies, for example.)

Certainly, you can put extra money in your emergency fund and use that to pay for all of these things. While some people successfully use that strategy, I find that there are often two things that go wrong:

People don’t have a big enough emergency fund and regularly deplete it to pay for things that they could/should have anticipated. Then they’re left with nothing when they lose their job or ability to work.

Others constantly worry when they have to use their emergency fund no matter how large it is. It’s easy to get used to having that money there and being able to mentally count on it. When that happens, it is extremely stressful to think about using any of it, even if it makes sense to do so. (This is what happens to me.)

That’s why I find that it is far better to use the strategies below to plan ahead for life’s surprises and unexpected expenses.

The Exception: Paying for Unexpected Expenses When You Have Debt

If you’re in debt, you need to prioritize paying that off first. Start with building an emergency fund with enough to pay your bills for one month. Then put your extra money toward your debt using a solid debt payoff strategy. During this time, you may need to use your emergency fund to pay for unexpected expenses.

Budgeting for Unexpected Expenses

Step 1: Make a list of possible unexpected expenses

Review your bank and credit card statements from the past year to identify costs that were surprising or irregular.

Then think through the upcoming year. What changes do you anticipate that you could plan for?

For example:

Is your car due for maintenance or new tires?

Are there upcoming life events like weddings or birthdays?

Could your home need repairs?

Will your child be old enough to start piano lessons or a new sport?

Is your friend about to get engaged or have a baby?

Remember your list doesn’t need to be perfect. Getting 80% of the way there is better than nothing.

Step 2: Create Savings Buckets for Unexpected Expenses

Next you are going to group the things on your list into categories. While it is perfectly fine to group the money you set aside for all surprise/unexpected expenses into one savings account, I find that most people function better by dividing it up.

You will create a savings account or subaccount for each of your categories. Sometimes these are referred to as “savings buckets” or “sinking funds.”

Your savings buckets can be as general or as specific as you’d like. Here are some examples of buckets that you might have:

Home repairs

Car expenses

Vacations

Clothes

A fund for a new home, wedding, party, or other major event

Kids activities

Medical expenses

Pet expenses

Taxes

Insurance

Holiday and/or birthday gifts and celebrations

Step 3: Determine Monthly Savings Goals

Decide how much to save for each category each month. Use one of these methods:

Specific goal: If you know you’ll need $6,000 for a new furnace in two years, divide the total by 24 months to determine how much to save monthly ($250).

Past spending: Look at what you’ve spent on similar expenses in previous years and divide that amount by 12 to calculate your monthly savings goal.

Pin this image to save for later!

Add up the total for each category to find out how much should be transferred to the designated savings account each month.

Step 4: Automate

Set up automatic transfers (ideally right after you get paid). This will ensure that you don’t forget and eliminate the need to think about it.

Step 5: Monitor

Periodically check in on your savings to make sure that the amount you are transferring still makes sense. Sometimes expenses are higher than expected and you may need to increase the amount saved each month.

Or you might find that you didn’t use all of the money and you wish to reduce the amount saved per month.

Why Planning for Unexpected Expenses Matters

Life is unpredictable, but with a little extra planning, you can prepare yourself to confidently handle whatever comes your way. Following these steps to prepare for unexpected expenses can save you from stress and help you stay on track with your financial goals.