Why You Need an Emergency Fund

Having an emergency fund is the single most important thing for keeping you from financial catastrophe, so it’s not surprising that single person in the financial advice industry recommends having an one.

An emergency fund is what prevents you from being unable to pay bills, going into debt, or declaring bankruptcy when bad things happen.

What is an emergency fund?

An emergency fund is just a name for the idea that you have money sitting in the bank that you can access in cases of job loss or unexpected, catastrophic medical expenses. Sometimes people will set up a separate savings account to keep this money out of sight and out of mind. My husband and I have chosen to keep a healthy balance in our savings account and there is a threshold that we never dip below. You have to figure out the system that works best for you.

What counts as an emergency?

There’s nothing quite like having your kitchen sink back up when you have guests over and spending the rest of the evening scrubbing pots and pans in the bathtub while worrying about how you’re going to pay for Roto Rooter to come by on a weekend. But this is not an emergency.

The vast majority of expenses should be expected, even if you don’t know exactly what they’ll be. Owning a home or car always involves expecting the unexpected. You should have a certain amount of money set aside just for paying those potentially unanticipated costs each year.

When you’re creating your money plan, consider your expenses for the entire year so that you can plan ahead. Include everything from vacations, to holiday spending, to insurance and property taxes that you’ll be paying later in the year. Save for these using sinking funds.

Having to attend a friend’s wedding that you didn’t know about is not an emergency. If you regularly find yourself paying for things you didn’t know you were going to do, plan for that. Build up an extra amount in your “just for fun” category to cover fun things you didn’t anticipate.

An emergency fund should only be used for truly catastrophic events like job loss or significant, sudden medical expenses.

How much should be in my emergency fund?

How much should be in my emergency fund is a highly personal question.

One common suggestion is 3-6 months worth of living expenses. Personally, I tend to err on the more conservative side and only feel comfortable if I have 9+ months worth on hand. I like to feel secure. This is a personal decision you should make based on your risk tolerance and life situation.

A few things to consider:

How stable is your income from one month to the next?

Do you and your spouse work in the same industry? What is the risk of being laid off at the same time?

Do you have any other “cushions” or sources of income?

How much insurance do you have and how comprehensive is it?

The size of your emergency fund depends on many factors. Most importantly, it depends on what amount enables you to sleep at night? What amount would give you comfort in terms of knowing that you’d be okay for awhile if something bad happened?

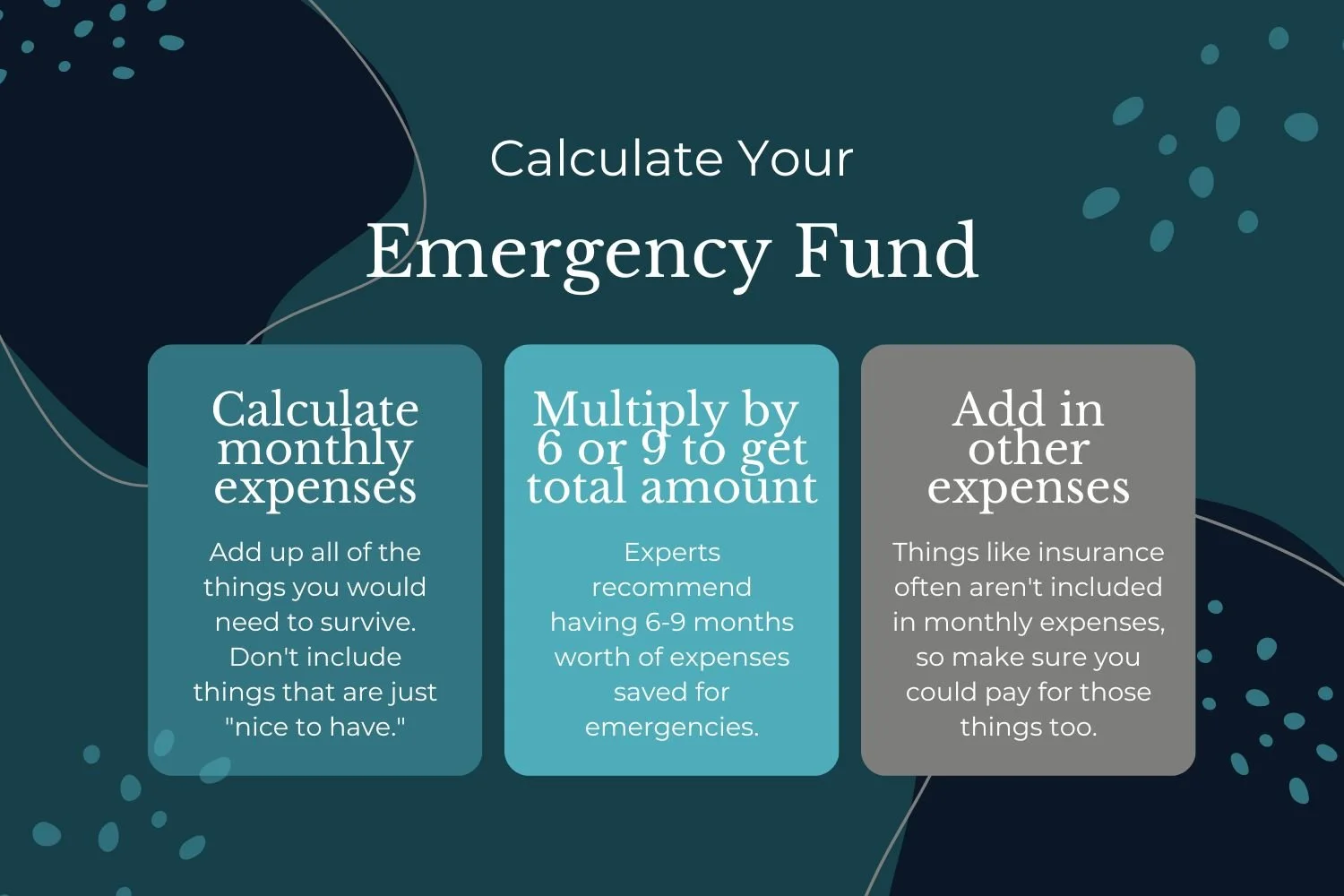

How do I calculate how much should be in my emergency fund?

In order to calculate how much should be in an emergency fund, you first need to know how much money you need to live each month. Add up your critical expenses for the month. Include things like mortgage/rent, utitilities, and food. Think about what you would do if you lost your job. You might stop eating out, spending money on entertainment, or buying new clothes. Don’t include these expenses in your total. Add up only the things you need for basic survival. (Yes, that includes cell phone and internet, as they are critical to life these days.)

Next, multiply your monthly amount by three. This is the absolute minimum amount you should have in your emergency fund. If you don’t have an emergency fund, getting to this 3-months of expenses number should be your first priority.

Once you’ve done that, you can start building your emergency fund into a more comfortable amount. Aim for 6-9 months worth of expenses while also working toward your other financial goals.

Make sure you add a bit extra to cover things that might not have been included in your monthly expenses. You might have a house insurance payment coming up, so you’d want to make sure you could pay that. Think about anything else that’s not already on your list that you would need to pay for.

Creating Security in Life

Remember, your emergency fund is about creating security in your life. While we often talk about it in terms of the numbers, your emergency fund is really designed to help you sleep at night, knowing that if something were to happen, you’d be okay. When it comes to your emergency fund, how much you need is about more than just the numbers—it’s about creating a system that will protect you and your family.