What is Zero-Based Budgeting and How Does It Work?

Do you ever reach the end of the month wondering where all your money went? Even though your income should be enough, it seems to disappear, leaving you feeling like there's never enough for everything you want or need. Then you start wondering how you’ll ever have enough for retirement, let alone your kids’ college education or vacations or anything else.

You might even find yourself wondering how you can be so good at so many things and yet so bad at money.

If you’re tired of feeling like you’re on a financial hamster wheel, struggling to get ahead or just pay the bills, it might be time to try zero-based budgeting. This powerful budgeting method can help you take control of your money by giving every dollar a purpose before it even hits your bank account.

There’s no one-size-fits-all approach to budgeting, but zero-based budgeting might be the key to helping you manage your finances more effectively. Keep reading to learn more!

What is Zero-Based Budgeting and Why Should You Consider It?

Zero-based budgeting is a powerful financial planning method that helps you take control of your money by assigning a purpose to every dollar you earn. Unlike traditional budgeting methods, where you may leave some money unaccounted for, zero-based budgeting ensures that your income minus your expenses equals zero at the end of each month.

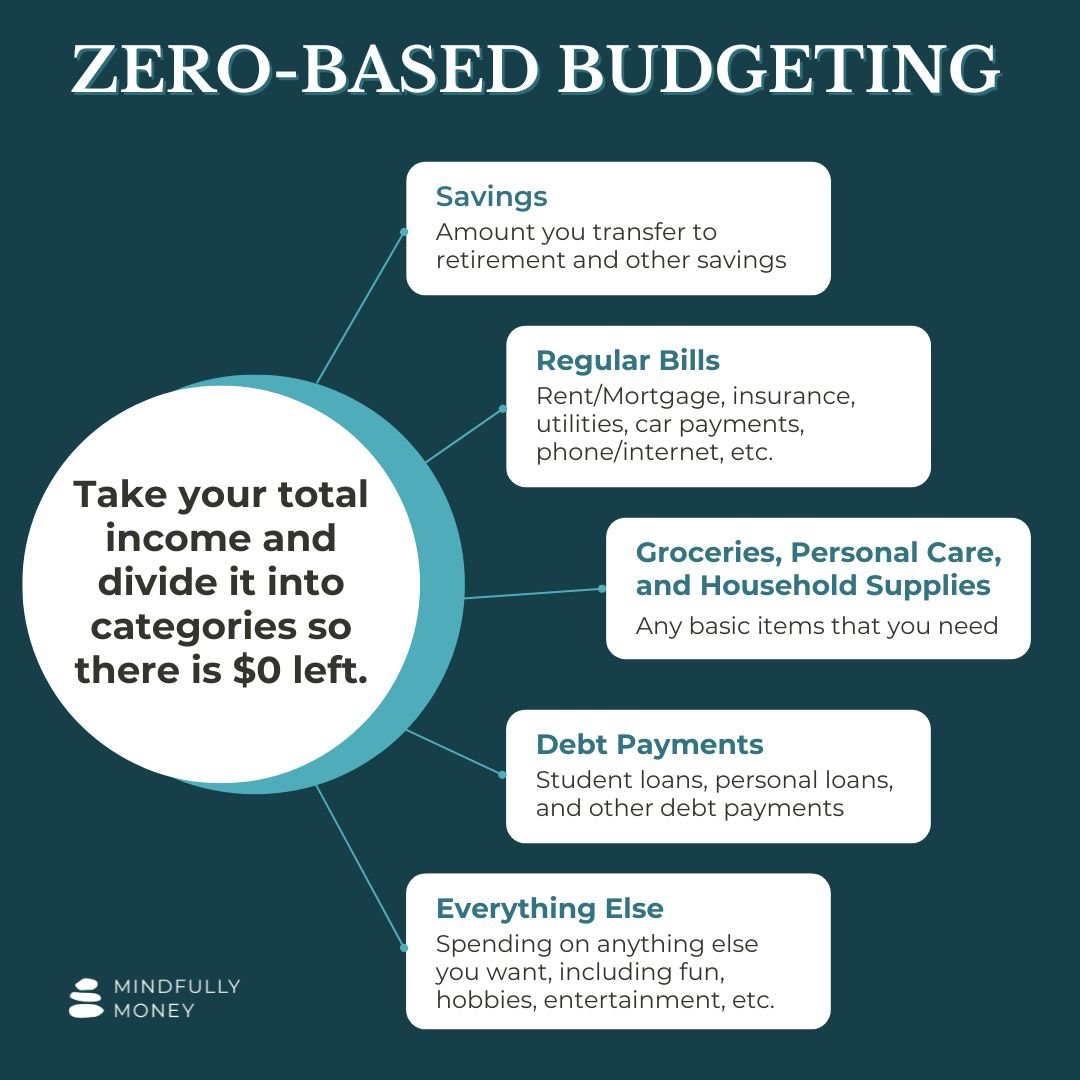

Think of it as a modern-day cash envelope system, but instead of using physical envelopes, you’re allocating funds digitally (or on paper). For example, when you receive your paycheck, you divide it into specific categories such as rent, utilities, groceries, savings, and debt repayment. Each category gets a designated amount, and once that amount is spent, you're done until the next budget cycle.

Here’s how it works: Let’s say your monthly income is $5,000. Before the month begins, you allocate this $5,000 to different categories like bills, savings, groceries, and entertainment. By the time you’ve assigned all your dollars to a category, you should have nothing left unaccounted for—hence, the term "zero-based." If an unexpected expense arises, you’ll need to adjust your budget by reallocating money from another category, using your emergency fund, or putting it on your credit card.

Because every dollar is given a specific role to play, it vastly decreases the chance that you’ll blow your money on random purchases. And, it increases the likelihood that you’ll save and pay off debt because you are deciding in advance to allocate money for those goals rather than leaving it to the end.

The beauty of zero-based budgeting lies in its flexibility. Your budget can change from month to month, adapting to shifts in your income, lifestyle, or financial goals. Plus, it can be adapted to your preferred style, whether it’s pen and paper, a spreadsheet, or an app.

How Zero-Based Budgeting Works

1. Decide on Your Budgeting Period

First, determine whether you will budget on a monthly basis, weekly basis or by each paycheck. A monthly budget provides a broader view of your finances, while paycheck budgeting allows for more granular control, especially if your income varies or if you have multiple paydays within the month.

2. Calculate Your Total Income

Add up all sources of income for the budgeting period. This includes your salary, side hustle earnings, rental income, and any other money that comes in. Knowing your exact income is the foundation of your zero-based budget.

3. Review Your Spending Habits

Before assigning your income to categories, take a close look at your current spending habits. Track your spending or review your bank statements and receipts to understand how much you typically spend on necessities like housing, groceries, and utilities, as well as discretionary items like entertainment or dining out. This step is crucial for setting realistic budget categories.

*Actual categories can be different than those listed.

4. Allocate Your Income to Budget Categories

Now, divide all your income into specific categories (think of them as your real or digital envelopes). Each category should have a clear purpose, such as rent, savings, debt payments, groceries, or entertainment. Remember, the goal is to ensure that every dollar has a job, so your income minus expenses equals zero.

5. Make Adjustments as Needed

Life isn’t static, and neither is your budget. Throughout the month, you may need to adjust your budget to accommodate unexpected expenses or changes in income. If you overspend in one category, you’ll need to take funds from another to stay within your budget. Regularly review and tweak your budget to ensure it remains aligned with your financial goals.

6. Plan for Irregular Expenses

To avoid budget surprises, set aside extra money in a savings account for irregular expenses that don’t occur every month, like car repairs, annual insurance premiums, or holiday gifts. This ensures that you’re prepared for these costs without disrupting your monthly budget.

Zero-Based Budget Example

Example: Charlie

Charlie is a single person who earns $4500/month. Charlie pays rent of $1200 and spends $300 on utilities each month. They own their own car, but spend about $200 on gas. The average monthly amount for insurance costs is $600. Charlie spends approximately $500/month on groceries and another $200 on miscellaneous items. They typically spend another $200/month on fun and entertainment. Charlie also has some debt payments (student loans and credit card debt) of $600/month and saves $700/month ($541 in a Roth IRA and the rest in a high yield savings account for emergencies).

You can divide your expenses into as many or as few categories as you’d like. Your goal is to make your budget work for your life, so do what makes sense for you. Keep in mind, however, that creating too many categories could make things overly complicated and hard to manage. Sometimes fewer is better.

Here’s how Charlie’s budget looks when you put it in my zero based budgeting worksheet:

Insurance is listed under sinking funds because it is paid yearly or twice per year instead of monthly. In order to have enough to pay the bill when it arrives, Charlie puts money into a savings account each month and keeps it there until the bill needs to be paid.

Learn more about sinking funds.

Notice that this budget is currently only displaying planned numbers. Expenses listed under “variable expenses” are those that change every month. In other words, you don’t know exactly what the amount will be. It’s important to keep track of how much you spend in these areas so that you know how much is available at any given moment.

At the end of the month, you can fill in the actual amounts you spent and make adjustments to the next month’s budget if needed.

Advantages and Disadvantages of Zero-Based Budgeting

Advantages of Zero-Based Budgeting

Many people find that zero-based budgeting is extremely effective when it comes to getting out of debt or finally starting to get ahead. This is because zero-based budgets force you to be intentional and more in control of where all of your money goes.

Prior to adopting a zero-based budget, many people find that they have no idea where their money is going. They pay their bills and go through life addressing things as they come up, and at the end find that there’s not enough. Zero-based budgeting breaks this cycle and helps you get ahead.

Here are some of the benefits:

1. Increased Financial Awareness and Control

Zero-based budgeting requires you to account for every dollar, which leads to a heightened awareness of your financial situation. By assigning every dollar a job, you're in full control of your finances. This method helps prevent money from slipping through the cracks, ensuring that your spending aligns with your financial goals.

2. Prioritization of Financial Goals

With zero-based budgeting, you proactively allocate funds to your most important financial goals, whether that's paying off debt, building an emergency fund, or saving for a major purchase. This structured approach ensures that your priorities are funded first, reducing the temptation to overspend on non-essentials.

3. Reduced Impulse Spending

By pre-planning your spending, zero-based budgeting helps curb impulse purchases. Since every dollar is allocated to a specific category, it becomes easier to resist the urge to spend money on unnecessary items, knowing that doing so would require sacrificing funds from another important area.

Learn how to stop overspending.

4. Effective Debt Reduction Strategy

For those focused on getting out of debt, zero-based budgeting can be particularly powerful. By allocating money to debt repayment first, you create a clear, actionable plan to pay off balances faster. This intentional focus on debt reduction can accelerate your progress and keep you motivated.

5. Easy to Implement with Various Tools

Zero-based budgeting can be implemented using a variety of tools that suit your personal style. Whether you prefer pen and paper, spreadsheets, or budgeting apps, the method is versatile and can be adapted to whatever system you find most convenient and effective.

Disadvantages of Zero-Based Budgeting

While zero-based budgeting is simple in theory, it’s not always so simple to execute, because life, of course, never goes exactly according to plan.

Here are some challenges of zero-based budgeting:

1. Time-Consuming to Maintain

Zero-based budgeting requires regular attention and detailed planning. Each month (or paycheck), you need to allocate your income down to the last dollar, which can be time-consuming. For those with busy schedules or who prefer a less hands-on approach to managing finances, this can be a significant drawback.

2. Potential for Over-Complication

Because zero-based budgeting involves meticulously assigning every dollar, it can feel overwhelming, especially if your income varies or you have numerous expense categories. The detailed nature of this method might lead some people to over-complicate their budget, making it difficult to stick to over time.

3. Challenges in Dealing with Irregular Expenses

Irregular or unexpected expenses, such as car repairs or medical bills, can disrupt a zero-based budget. While you can plan for these by setting aside money in advance, it requires a level of foresight and discipline that can be challenging for those new to budgeting.

4. Risk of Becoming Too Restrictive

Zero-based budgeting can sometimes feel restrictive, particularly if you set tight limits on discretionary spending. This restriction might lead to feelings of deprivation, which can, in turn, cause budget fatigue and make it harder to stay committed to your financial plan.

5. Requires Consistent Monitoring and Adjustments

Sticking to a zero-based budget means consistently monitoring your spending and making adjustments as needed. This ongoing effort can be challenging, particularly if life circumstances change frequently or if you struggle with staying organized.

6. May Not Accommodate Variable Incomes Easily

For those with variable incomes, such as freelancers or commission-based workers, zero-based budgeting can be difficult to implement. Estimating income accurately becomes essential, and fluctuations can complicate the budgeting process, leading to either shortfalls or surpluses that require constant rebalancing.

Remember, many people have had success with zero-based budgeting despite these risks and challenges. What’s most important is to find something that is a good fit and that you can adjust to your needs.

Who should use zero-based budgeting?

Zero-based budgeting can be a game-changer for anyone looking to take control of their finances, but it’s especially helpful for those who feel like their money is slipping through their fingers each month. If you're serious about getting out of debt, this method can provide the structure and focus you need to finally make progress. It's also great for anyone who wants to be more intentional with their spending, ensuring that every dollar you earn is working towards your goals.

However, if you find detailed budgeting to be overwhelming or if your income consistently exceeds your expenses, a zero-based budget might feel too restrictive or time-consuming. In that case, you might prefer a more flexible approach.

If you’ve been feeling stuck, frustrated, or just plain overwhelmed by your finances, zero-based budgeting might be the fresh start you need. While learning a new budgeting method can be challenging, it’s also an opportunity to take control and start making your money work for you. Remember, there’s no one-size-fits-all approach—zero-based budgeting is flexible and can be customized to fit your unique situation.

It’s okay if it takes some time to get the hang of it. Start small, make adjustments as needed, and don’t hesitate to explore tools or apps that can make the process easier. And if you ever find yourself needing extra support or guidance, consider working with a financial coach. Sometimes, having a little extra support and guidance can make all the difference in getting back on track and achieving your financial goals.

Pin this image to save for later: