How to Pay Your Credit Card Bill in Full Every Month

The other day, while scrolling through my usual personal finance threads, I stumbled upon a post from someone who wanted to pay off her credit cards in full every month to avoid interest, but she wasn’t sure how or where to start. It struck me that while this might seem obvious to some, it’s not surprising at all that many people find it confusing. After all, this isn't something we're taught in school, and let’s be honest—credit card companies aren’t exactly motivated to make this process easy to understand.

If you've ever felt embarrassed about asking questions like these, please know that you're not alone. Many people struggle with this, and there's absolutely no shame in wanting to learn how to manage your finances better. In fact, being curious and proactive about your financial health is something to be proud of.

So, if you’ve been wondering how to pay off your credit card in full every month but aren't sure where to begin, this guide is for you. I’ll walk you through the process step-by-step, so you can feel confident in taking control of your credit card payments and avoiding unnecessary interest.

What does it mean to “pay your credit card in full”?

Paying your credit card in full means that you’re paying the entire balance that appears on your monthly statement by the due date. This balance is often referred to as the “new balance” or “statement balance.” When you pay this amount in full, you’re essentially covering all the purchases and charges made during that billing cycle, preventing any interest from accruing on your account.

For many people, the idea of paying their credit card in full can seem daunting—especially if they’ve been carrying a balance from month to month. But paying in full doesn’t mean paying off your entire credit card debt all at once (unless you want to); it simply means paying off what you owe from that billing cycle.

Why you should pay your credit card in full every month

Paying your credit card in full every month is one of the best habits you can develop for your financial health. Here’s why it matters:

1. Avoid Interest Charges: When you pay your balance in full by the due date, you avoid paying interest on your purchases. Credit card interest rates can be notoriously high, and carrying a balance from month to month means you’ll be paying more for the things you buy—sometimes a lot more. By paying in full, you’re essentially getting a free loan for the duration of the billing cycle.

2. Keep Your Debt Under Control: Credit cards can be a double-edged sword. They’re convenient and can help you build your credit, but they can also lead to debt if not used carefully. Paying off your balance each month prevents debt from piling up, helping you stay in control of your finances.

3. Boost Your Credit Score: Your credit utilization—the amount of credit you’re using compared to your credit limit—is a major factor in your credit score. Paying your balance in full keeps your utilization low, which can have a positive impact on your credit score. A higher score opens up better financial opportunities, like lower interest rates on loans and better terms on mortgages.

4. Build Responsible Financial Habits: Getting into the routine of paying your credit card in full each month sets a strong foundation for responsible money management. It teaches you to live within your means, budget effectively, and make conscious spending decisions.

5. Reduce Stress and Anxiety: Financial stress is real, and carrying a credit card balance can add to that anxiety. Knowing that you’re paying your card off every month gives you peace of mind, allowing you to enjoy the benefits of credit without the worry of accumulating debt.

By making it a priority to pay your credit card in full each month, you’re not just avoiding the pitfalls of debt—you’re actively taking charge of your financial future. It’s a great way to stay in control and ensure that your credit card works for you, not against you.

How to pay your credit card in full

1. Understand your credit card statement

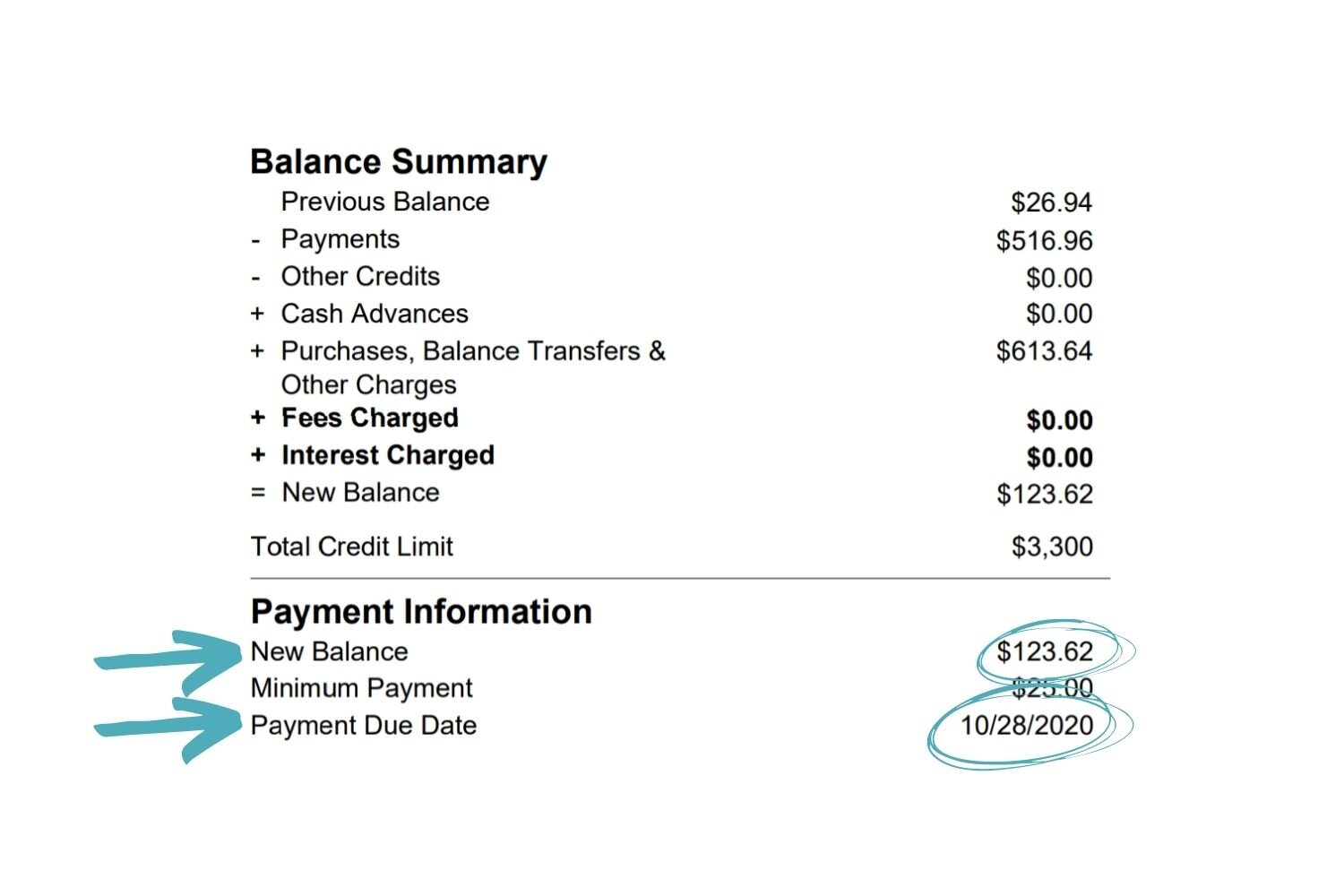

Take a look at your credit card statement. You’re going to see a bunch of different numbers. If you want to pay in full and avoid accruing interest, there are only two numbers you need to pay attention to: the “new balance” and the “payment due date.” Sometimes the “new balance” is also known as the “statement balance.”

If you look at the above statement, the new balance is $123.62 and the payment due date is 10/28/2020.

Step 2: Make Your Payment

Now that you’ve identified the “new balance” or “statement balance” on your credit card statement, the next step is to make your payment. Here’s how to do it:

1. Choose Your Payment Method: You have a few options for paying your credit card bill, depending on what’s most convenient for you:

Online Banking: Log into your bank’s online portal or mobile app, find the bill payment section, and add your credit card as a payee. This method is quick and allows you to easily track your payments.

Credit Card Provider’s Website or App: Most credit card companies allow you to make payments directly through their website or app. You can link your checking account and schedule the payment in just a few clicks.

Automatic Payment: If you want to make sure you never miss a payment, consider setting up automatic payments. You can usually choose to pay the full statement balance each month, the minimum payment, or a fixed amount. Just make sure you have enough funds in your checking account to cover the payment.

2. Schedule the Payment: It’s important to schedule your payment so it arrives before the due date. Most credit card payments take a day or two to process, so try to schedule your payment at least three days before the due date to ensure it’s credited on time. If you’re using online banking or your credit card provider’s website, you can often choose the date the payment will be made.

Credit cards can be a helpful tool for building credit, giving you additional financial security on your purchases, accruing cash or other rewards, and providing you with extra convenience. Although some financial gurus think that credit cards are evil, there’s really no reason not to have one if you can use it responsibly by paying it off in full every month.

3. Confirm the Payment: After you’ve made the payment, take a moment to confirm that it was successful. Most online platforms will give you a confirmation number or send you an email receipt. Keep this information handy in case there’s ever a question about whether the payment was received on time.

4. Keep an Eye on Your Checking Account: Once you’ve made your payment, monitor your checking account to ensure the funds are withdrawn as expected. This helps you avoid any potential overdrafts or issues that could arise if the payment doesn’t go through as planned.

5. Monitor Your Credit Card Balance: After making your payment, keep an eye on your credit card balance to see how it changes. If you continue to use your card after making the payment, remember that new purchases will add to your balance, which you’ll need to pay off in full in the next billing cycle to avoid interest.

6. Set Up Reminders: If you’re not using automatic payments, consider setting up reminders to help you remember to make your payment on time. You can set alerts on your phone, through your bank, or your credit card provider’s app.

7. Celebrate Your Success! Paying off your credit card in full each month is a great accomplishment. It shows that you’re taking control of your finances and making responsible choices. Give yourself a pat on the back for taking this important step toward financial wellness!

FAQs

Does the balance have to be zero in order to avoid interest?

No, your balance doesn’t have to be zero to avoid interest. To avoid paying interest, you need to pay the full amount listed under the “new balance” or “statement balance” by the due date each month. You can continue using your card and carrying a balance as long as you pay off the statement balance on time.

Can I make multiple payments throughout the month?

Yes, you can make as many payments as you’d like throughout the month. Some people prefer to make smaller payments more frequently, like paying half from each paycheck. The key is to ensure that the total amount listed on your statement is paid in full by the due date. Just keep in mind that multiple payments might make tracking your spending a bit more challenging.

What happens if I only make the minimum payment?

If you only make the minimum payment, the rest of your balance will carry over to the next month, and you’ll be charged interest on that remaining amount. While paying the minimum keeps your account in good standing and avoids late fees, it can lead to costly interest charges and make it difficult to pay off your debt.

How do I know how much to pay to avoid interest?

To avoid interest, you need to pay the amount listed as the “new balance” or “statement balance” on your credit card statement by the due date. This is the total of all charges made during the billing cycle, minus any payments or credits.

What are all those other numbers?

Minimum Payment: The amount you have to pay if you want to avoid late fees and other penalties. You will be charged interest if you only make the minimum payment.

Total Credit Limit: The maximum amount you can charge on your card at any one time. The outstanding balance can never exceed this amount.

Outstanding/Current Balance: The total amount due at the present moment, which includes your previous statement balance plus any new charges, minus any payments made since the statement date.

Available Credit: The amount you can spend before you hit your limit. It is calculated by taking the total credit limit and subtracting the outstanding balance.

What happens if I pay my current balance?

Paying your current balance is okay, but it might not help you build credit. If you pay off your balance before your statement date, your statement might show $0 due. This means that there is nothing to report to the credit agencies, and you will not be building your credit history and increasing your credit score.

That’s why it’s best to just automatically pay the statement balance after the statement date and before the due date.

Will paying off my credit card in full every month help my credit score?

Yes, paying off your credit card in full every month is one of the best ways to build and maintain a good credit score. It shows lenders that you’re responsible with credit and can manage your finances well. Plus, it keeps your credit utilization low, which is a key factor in your credit score.

What if I can’t pay the full statement balance?

If you can’t pay the full statement balance, try to pay as much as possible above the minimum payment to reduce your balance and minimize interest charges. If you find yourself consistently unable to pay your balance in full, consider revisiting your budget and spending habits to avoid accumulating more debt.

How to Find the Money to Pay Your Credit Card in Full Every Month

Knowing how to pay your credit card in full every month and having the money to do so are two very different things. If you’re struggling to do so, here are some things you can do:

1. Track your spending for a few weeks

Simply write down everything you buy, including store, amount, general description, and what led you to make the purchase. Was it something you planned in advance? Was it an emotional purchase? Was it a social situation?

Keeping a money diary will give you insight into your spending habits. My clients who do this are often surprised by what they discover. Once you have this information, you can make more intentional decisions about how you’re using your money.

Use a small notebook, the notes app on your phone, or my free expense tracking worksheet.

2. Create a budget or spending plan

A budget or spending plan doesn’t have to be restrictive—it’s simply a tool to help you be more in control of where your money goes.

Get started with my guide to budgeting for beginners.

3. Reduce expenses

Check out the resources on my blog to help you find ways to cut back on spending.

4. Increase your income

Sometimes earning more money is the best way to pay off debt and save more money. You can get an extra job, ask for a raise, or even sell things that you own.

Paying off your credit card in full every month might seem daunting at first, but it’s a crucial habit for maintaining your financial health. By understanding your credit card statement, making timely payments, and staying organized, you can avoid interest charges, build a strong credit score, and gain greater control over your finances.

Remember, it’s okay if you’re still learning—everyone starts somewhere, and taking these steps shows you’re on the right path.

If you ever feel overwhelmed or unsure, don’t hesitate to seek out guidance. You deserve to feel confident in your financial decisions, and sometimes a little support can make all the difference.

Click here to learn about financial coaching!

Pin for later: